-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2023-04-02

Date :

2023-04-02

Stock In Focus - Week 14 (2023) – AUSTRALIA – VOLUME SPIKE TRADING STRATEGY

The week beginning Monday, the 3rd April is Week 14 as per ISO numbering convention of the weeks of a year.

Country in focus:

This week we look at the Stocks from Australia in S&P ASX200 index.

Stock/ETF in focus:

Specific Stock in focus is Chalice Mining Limited (Ticker: CHN). The Stock is listed in Australian Stock Exchange (ASX), the trading currency is Australian Dollars or AUD.

Trade Direction:

BULLISH, Volume Spike study since beginning of 2020 reveal 72.7% probability of success in a BUY (LONG) trade. Please note that probability is not certainty, so always trade with complete discipline of risk management and that there is a plan if trade does not playout as anticipated.

Most Recent Event:

Most recent Volume spike event was on Tuesday, the 28th March 2023. Usually, the trade is opened on the day after the Volume Spike event, or wednesday, the 29th or 39th March. But, since this blog is being written over the weekend, the potential trade opening is the next market open day on Monday, the 3rd April.

Overview:

Chalice Mining Limited operates as a mineral exploration and evaluation company. Chalice Mining Limited was incorporated in 2005 and is based in West Perth, Australia.

The company explores for gold, copper, cobalt, palladium, platinum group element, and nickel deposits. Its flagship properties include the Julimar Nickel-Copper-Platinum group element project that covers an area of approximately 740 square kilometres located in Avon Region, Western Australia; and the Barrabarra Nickel -Copper- Platinum group element project located in Geraldton. It also holds interest in Hawkstone Nickel-Copper-Cobalt project located in Kimberley and Southwest Nickel-Copper- Platinum group element project located in Perth, Western Australia.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Basic Materials

Industry: Other Industrial Metals & Mining

Full Time Employees: 43

(Courtesy: Yahoo Finance)

Fundamentals:

52 Week Range 3.37 - 7.74

Volume 3,881,663

Market Cap 2.82B

Beta (5Y Monthly) 0.21

PE Ratio (TTM) N/A

EPS (TTM) -0.19

Earnings Date Mar 14, 2023

(Courtesy: Yahoo Finance)

Current trading price:

As of Tuesday, the 28th March 2023, or the day the latest Volume Spike event took place, the stock closed at 6.84. The size of the Volume Spike was 3.03X of the average volume. The earlier spike in volume was another on 22nd November 2022 with a spike size of 3.42X. This is significant and indicative of buying frenzy in the market.

The last closing price on Friday, the 31st March was 7.49, which is a 9.5% BULLISH move from Tuesday, the day the Volume Spike event occurred.

VOLUME SPIKE EVENT:

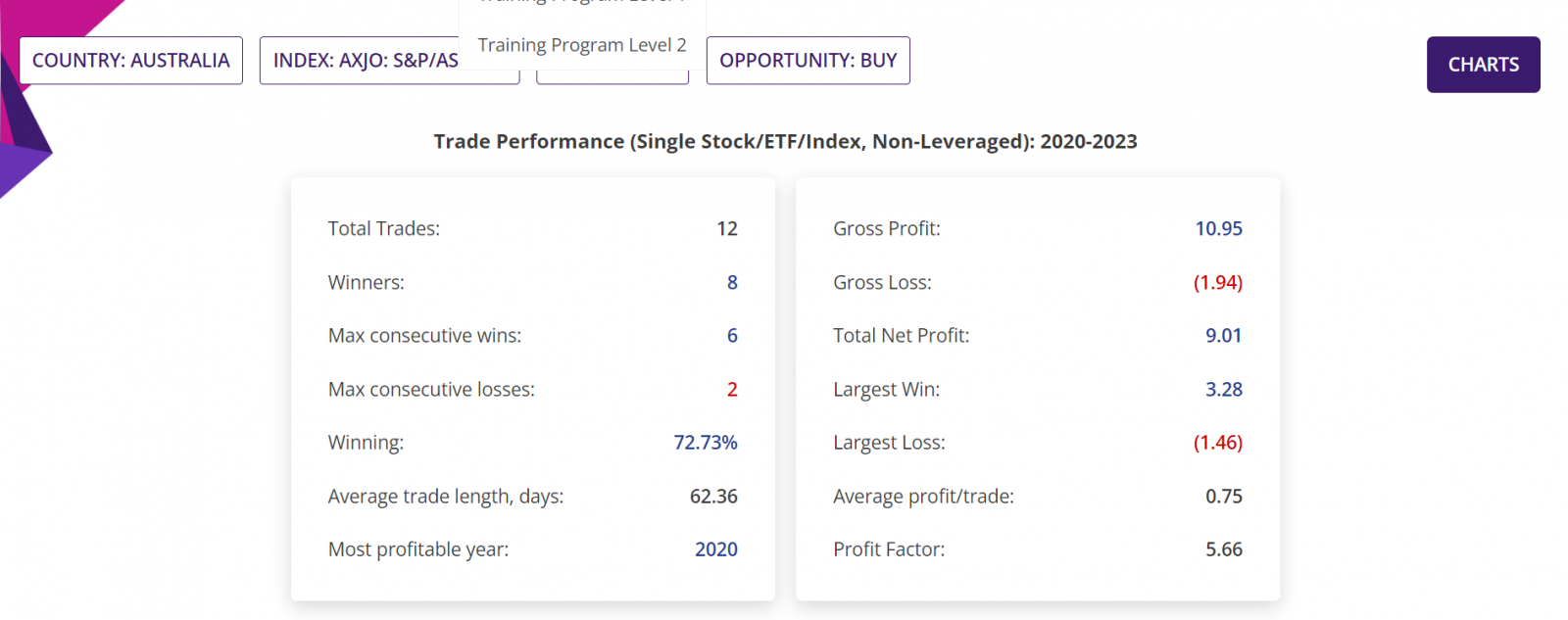

The Stock was BULLISH 72.7% of the time following Volume Spike events since the beginning of 2020, average spike size being minimum of 3X. Here is the key Volume Spike event performance of the Stock:

Summary report: Since beginning of 2020, there were 12 Volume Spike events, out of which the latest event of 28th March is yet to be traded, that is the current BULLISH trading opportunity being discussed in this blogpost. These leaves 11 completed trades using Volume Spike trading strategy, of which three were 8 winners (and hence 72.7% confidence or Probability) with average move up (AMU) of whopping 60.47% and average move down (AMD) of 8.04% for an average holding time (ADH) of about 40 days.

Historical RRR in those completed trades was a staggering 4.49:1. Please note that RRR shown here is a worst-case scenario, as many trades could be closed sooner with higher profit compared to trades closed at the end of 9-week period.

Detailed Report, Trade Performance: If 1,000 stocks were bought following those Volume Spike events, then a trader would have had a Gross Profit of $10,950, Gross Loss of $1,950, making a Total Net Profit of $9,010. In those closed trades, the Largest Win was $3,280, the Largest Loss is $1,460, the Average profit/trade being $750. All figures above are in AUD.

The Profit Factor (which is quotient of Gross Profit and Gross Loss) in those trades was a whopping 5.66.

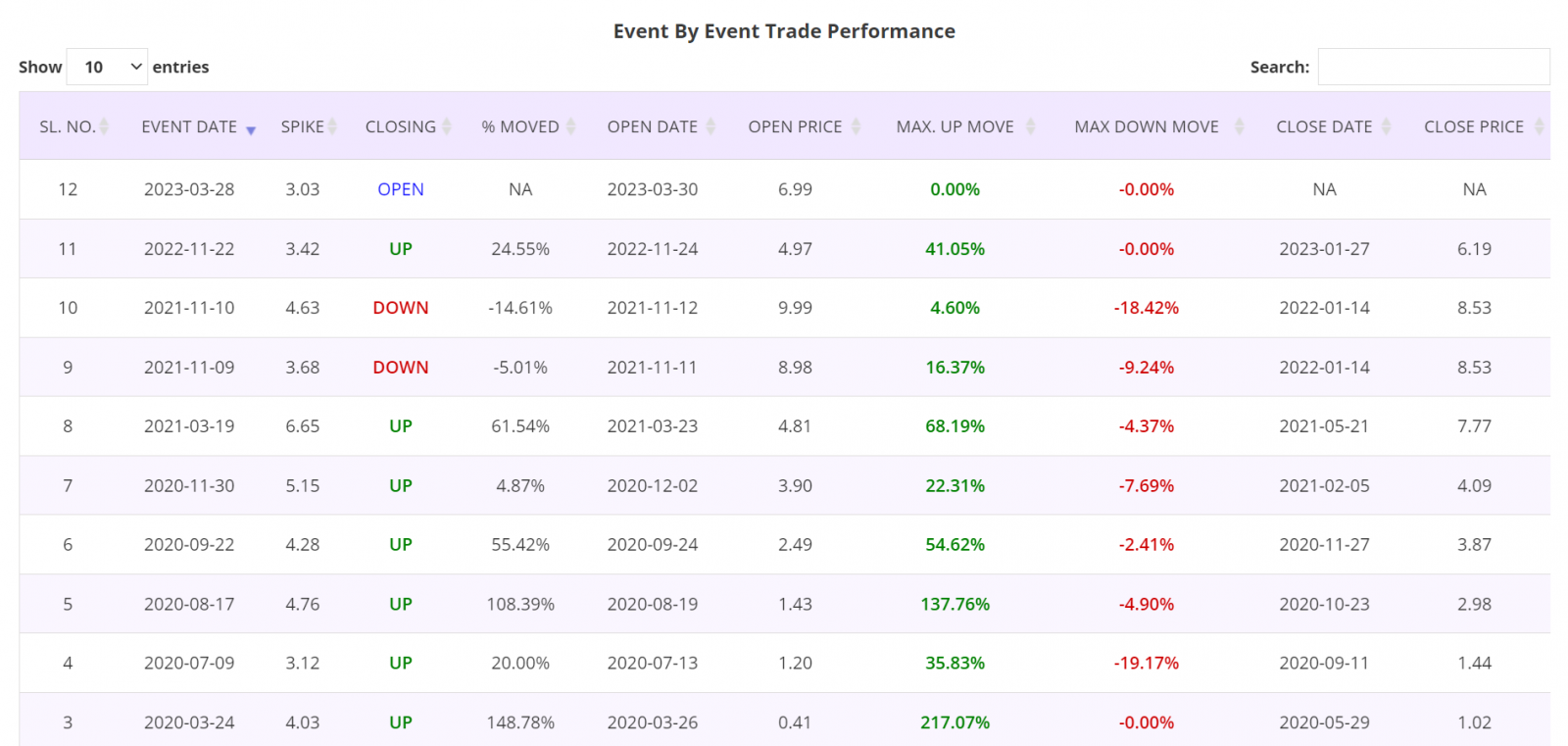

Detailed Report, Trade by Trade Performance: Results of each trade taken following the Volume Spike events since the beginning of 2020 are as shown in the table below. As can been seen in the table, 8 (green bars in the Histogram chart) out of 11 trades were winners. These tables are from the Detailed report of the Volume Spike trading app.

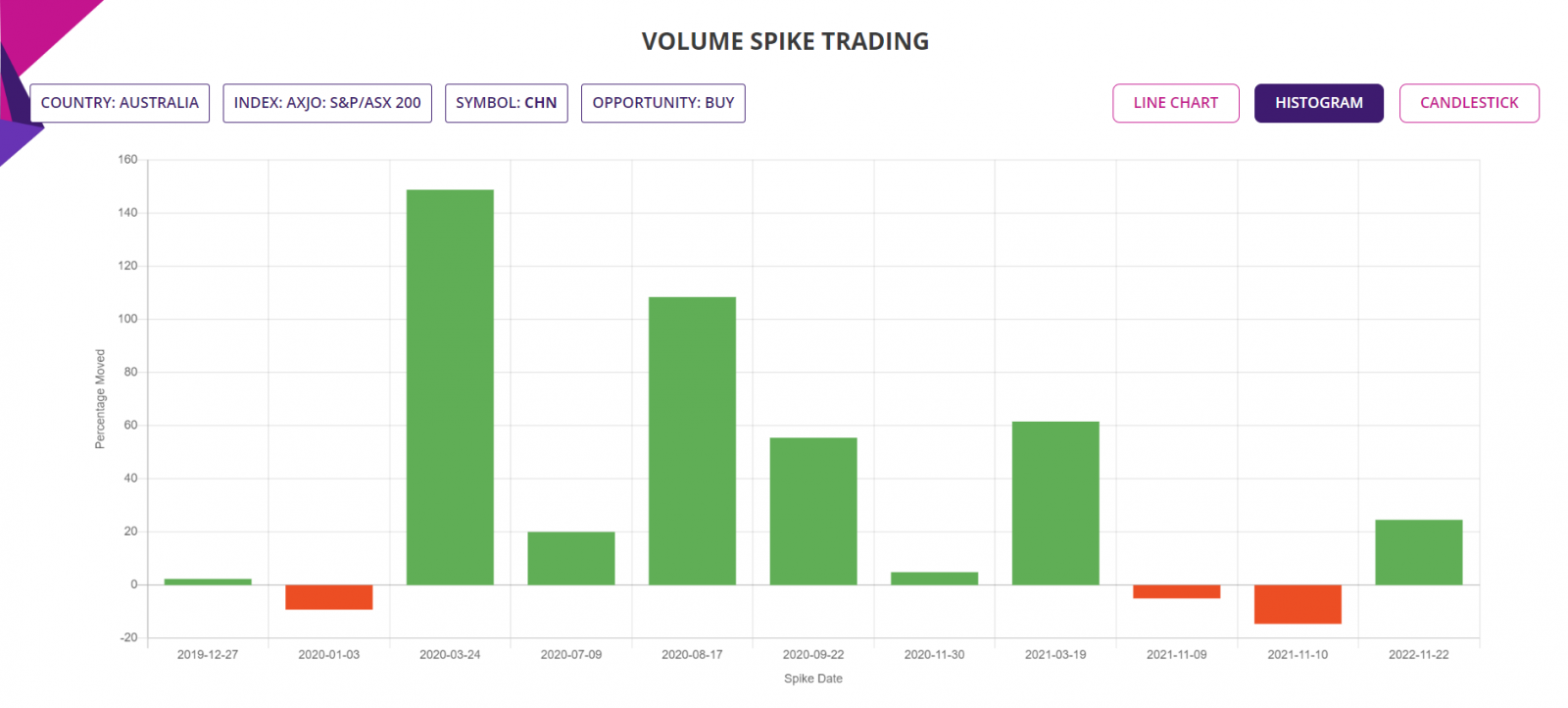

Histogram Chart: The chart below shows the percentage moves of the underlying Stock of Interest following each Volume Spike event for the period of analysis mentioned earlier, for a quick visual clue of the trade-by-trade performance.

Candlestick Chart: The candlestick chart of the underlying Stock/ETF’s latest performance is as shown below. In the web-based Volume Spike trading app, the chart is available for all the Volume Spike events since the year in the “Data since” in the input filter page.

Trade Structure:

We would trade the Stock as CFD trade, structured as follows:

|

TRADE STRUCTURE (All prices in Australian Dollars or AUD) |

||

|

Stock price |

$7.49 |

USD |

|

CFDs |

1,000 |

Number of Stocks used for this CFD trde |

|

CFD Margin |

10% |

CFD leverage |

|

|

|

|

|

Margin |

$749.00 |

Amount of fund required for the trade |

|

|

|

|

|

Target Stock price |

$8.61 |

15% above the current price, limit order placed at this underlying price |

|

Stop Stock price |

$7.12 |

5% below the current price, guaranteed stop at this price |

|

|

|

|

|

Profit Target |

$1,123.50 |

|

|

Stop Loss |

$374.50 |

|

|

RRR |

3 |

|

All P&L in the table above are exclusive of commissions or CFD interest paid.

The choice of RRR of 3:1 is historically consistent with the averages of the 11 trades placed since 2020 using the Volume Spike strategy.

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit http://www.sapphirecapitals.com/Disclaimer.