Trading Proficiency Training Program Level - 2

Pinnacle of Options trading with near zero risk trading strategies

Built upon skills learnt in Trading Proficiency – Level 1, this advanced training program makes a quantum jump by showing how to dramatically reduce risk by using a portfolio of Options. The program teaches several custom strategies that could be built using multi-leg Options trade with its own unique P&L chart.

The Level - 2 training program uses advanced concepts that need to be understood well before the trading strategies can be implemented. Those advanced concept are built on the Level – 1 training program but takes those to next level so that traders develop the proficiency to build their own custom near zero-risk Options trade.

Chapter Highlights - Trading Proficiency Training Program Level - 2

- Near Zero Risk Options Trading (NZRT) - Introduction

- Near Zero Risk Options Trading (NZRT) - Important Concepts

- Most Important Concept - Volatility

- Smart Coverd Call - Near Zero Risk Options Trading (NZRT)

- Near Zero Risk Options Trading (NZRT) - Strategy 1

- Near Zero Risk Options Trading (NZRT) - Strategy 2

- Near Zero Risk Options Trading (NZRT) - Strategy 3

- Near Zero Risk Options Trading (NZRT) - Strategy 4

Genesis of Near Zero-Risk Options Trades

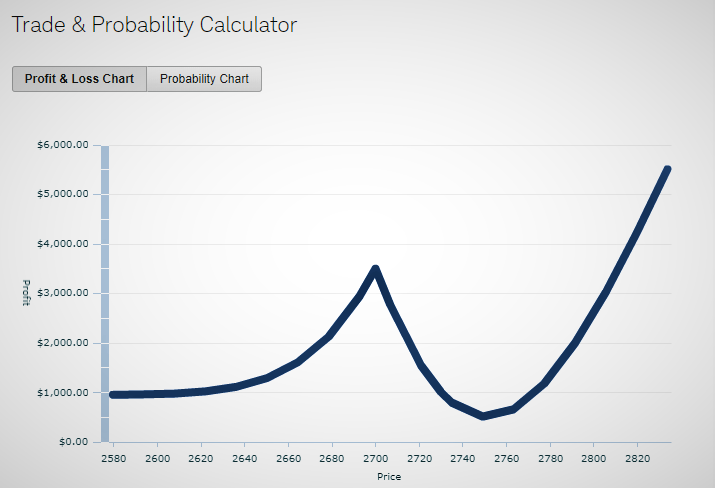

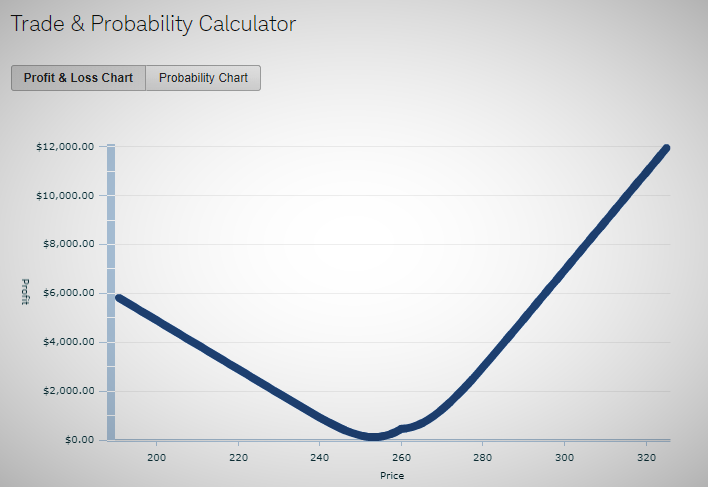

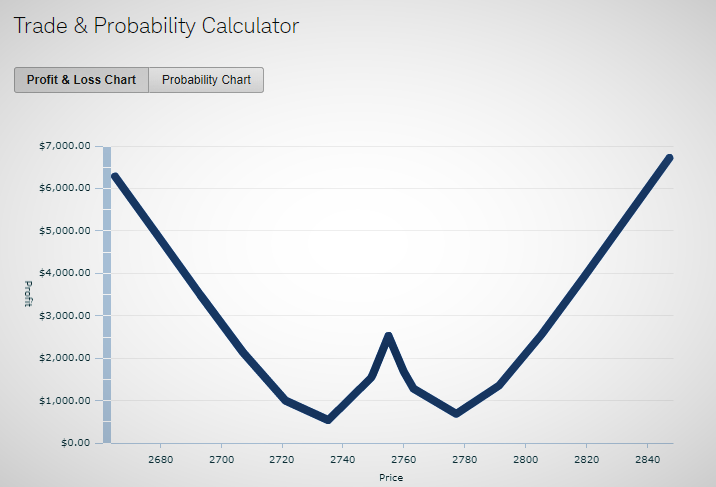

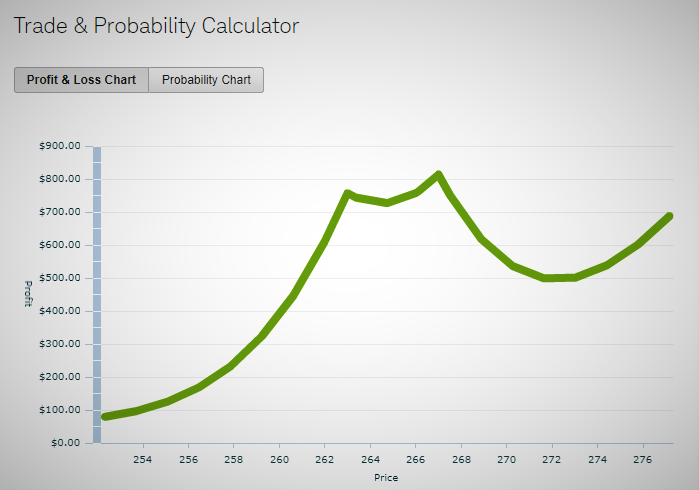

It is every trader’s dream to completely eliminate trading risks and why not? After all, who wants to be in a risky trading position? The Trading Proficiency Training Program Level – 2 teaches a range of trading strategies where the trade could be initiated using a portfolio of Options that is projected to be risk-free or near-zero risk. Such trades create some very fascinating P&L charts as shown below. Note that the entire chart is above the zero line, meaning, the trade is projected to be profitable at any value of the underlying, and hence risk-free.

Unmatched Sophistication In Trading Options

Although, these portfolio of trades are projected to be risk-free, but they are not totally risk-free and there are variety of factors that can make these apparent risk-free trades into a losing trades, however minimal. It is very critical that traders understand the key concepts as included in this program and manage these trades in a manner that can get as close to the risk-free trade as possible.

Accordingly, the training program lays emphasis on a range of topics including the following:

- Implied volatility and VIX, factors contributing to expansion and contraction, their effect on Options pricing;

- Effect of timing the market entry at various implied volatility environment and make correct assessment of what to expect as the trade plays out;

- Understanding the interplay among implied volatility, Options pricing and extrinsic value of the Options and their effect on the risk;

- Or simply create a two-leg Options trade to reduce the cost base and then remaining on the trade completely risk free

Risk Management in Near Zero-Risk Options Trade

It is absolutely imperative that the principles behind these sophisticated trading strategies are clearly understood by the traders first, tried in a simulated environment to gain good understanding of the behaviour under various market conditions, gain confidence and then engage in real markets.

These trades are not zero-risk or risk-free, they are near zero-risk, meaning, risk do exist and traders need to recognise those and understand the source. Once these risks are understood, it becomes easier to manage the trades. These trades do need higher level of management compared to any other Options trade because of various factors at play in financial markets. The Trading Proficiency training program Level – 2 includes detailed discussion of the risks and how to manage those in most effective way.

As always, trading capital preservation is first and foremost before aiming to be profitable in financial markets.