-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-09-11

Date :

2022-09-11

Stock In Focus - Week 37 (2022) – UK – SEASONALITY TRADING STRATEGY

The week beginning Monday, the 12th September is Week 37 as per ISO numbering convention of the weeks of a year.

Country in focus:

This week we look at the Stocks from UK in FTMC: FTSE 250 index.

Stock/ETF in focus:

Specific Stock in focus VinaCapital Vietnam Opportunity Fund Limited (Ticker: VOF), listed in London Stock Exchange (LSE), trade currency being in GBP.

Trade Direction:

BULLISH, Seasonality study for last 10 years reveal 80.0% probability of success in a BUY (LONG) trade for this week and 80% probability for the trade next week (Week 38).

Overview:

VinaCapital Vietnam Opportunity Fund Limited specializes in private equity investments. The fund seeks to invest 80 percent of its portfolio in private equity and 20 percent in equitization projects will be re-allocated to listed shares. The fund also makes private investments. It invests in stocks of companies operating across the diversified sectors. The fund invests in value stocks of companies having any market capitalization. It prefers to invest in Vietnam.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Financial Services

Industry: Asset Management

Full-time employees: 200

(Courtesy: Yahoo Finance)

Fundamentals:

52-week range 4.78 - 551.00

Avg. volume 146,247

Market cap 828.563M

Beta (5Y monthly) 0.57

PE ratio (TTM) 2.57

EPS (TTM) 1.98

Earnings date 24 Oct 2022 - 28 Oct 2022

Forward dividend & yield 0.12 (2.39%)

Ex-dividend date 07 Apr 2022

(Courtesy: Yahoo Finance)

Current trading price:

As of Friday, close of 9th September 2022, the stock was trading at 508.00. All prices are in GBP.

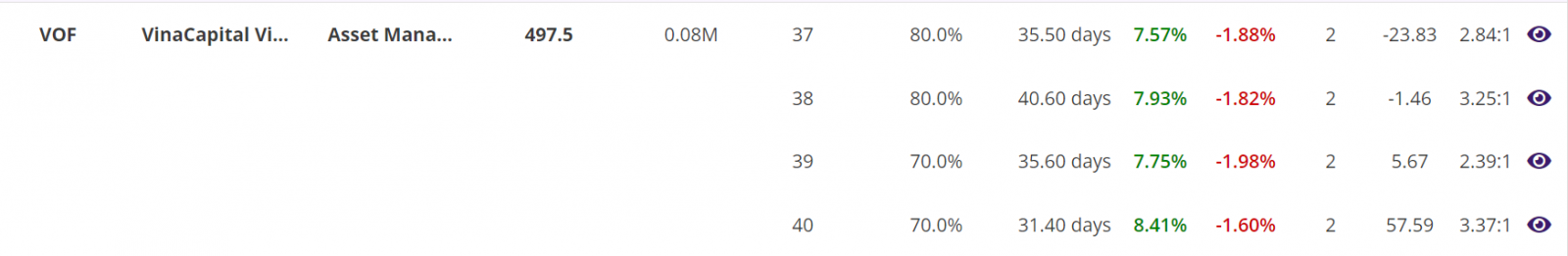

SEASONALITY:

The stock demonstrated strong SEASONAL move in week 37 of the year, here are some of the details of its SEASONAL behaviour:

- In 8 out of last 10 years in week 37, the stock was BULLISH with average move up (AMU) of 7.57% and average move down (AMD) of 1.88% for an average holding time (ADH) of 36 days.

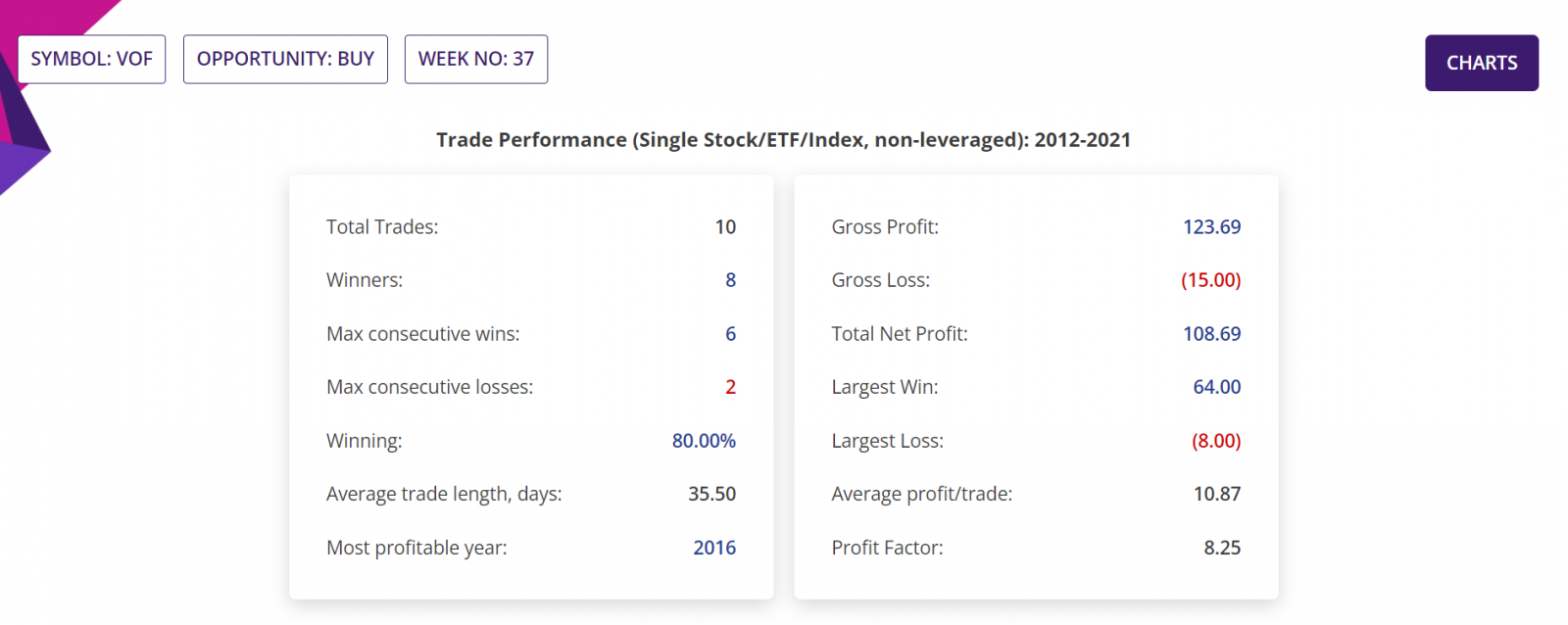

- If 10,000 stocks were bought in the beginning of week 37 every year for last 10 years, then a trader would have had a Gross Profit of GBP12,369.00, Gross Loss of GBP1,500.00, making a Total Net Profit of GBP10,869.00. All figures excluding commissions.

- In those 10 years, the Largest Win was GBP6,400.00, Largest Loss is GBP800.00, the Average profit/trade being GBP1,087.00. All figures excluding commissions.

- The worst-case average Reward-Risk Ratio (RRR) for all 10 trades over last 10 years was 2.84:1 and Profit factor being 8.25.

Trade Structure:

If we had traded the Stock this week, then we would have structured the trade as follows:

|

TRADE STRUCTURE (All prices in Great Britain Pound, GBP) |

||

|

Stock price |

508.00 |

Assuming trade placed at last traded price |

|

Stocks |

1,000 |

Number of Stocks used for this trade |

|

Investment required |

5,080 |

Amount of fund required for the trade |

|

Target Stock price (TP) |

560.07 |

10% above the current price |

|

Stop Stock price (SL) |

495.30 |

2.5% below the current price |

|

Profit Target |

521.00 |

Limit order placed at underlying TP price |

|

Stop Loss |

127.00 |

Guaranteed stop at SL price |

The choice of RRR of 4:1 is historically consistent with the averages of the 10 trades in each of the last 10 years in Week 37, since 2012 till 2021.

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2012-2021:

Year by year Trade Performance:

Histogram:

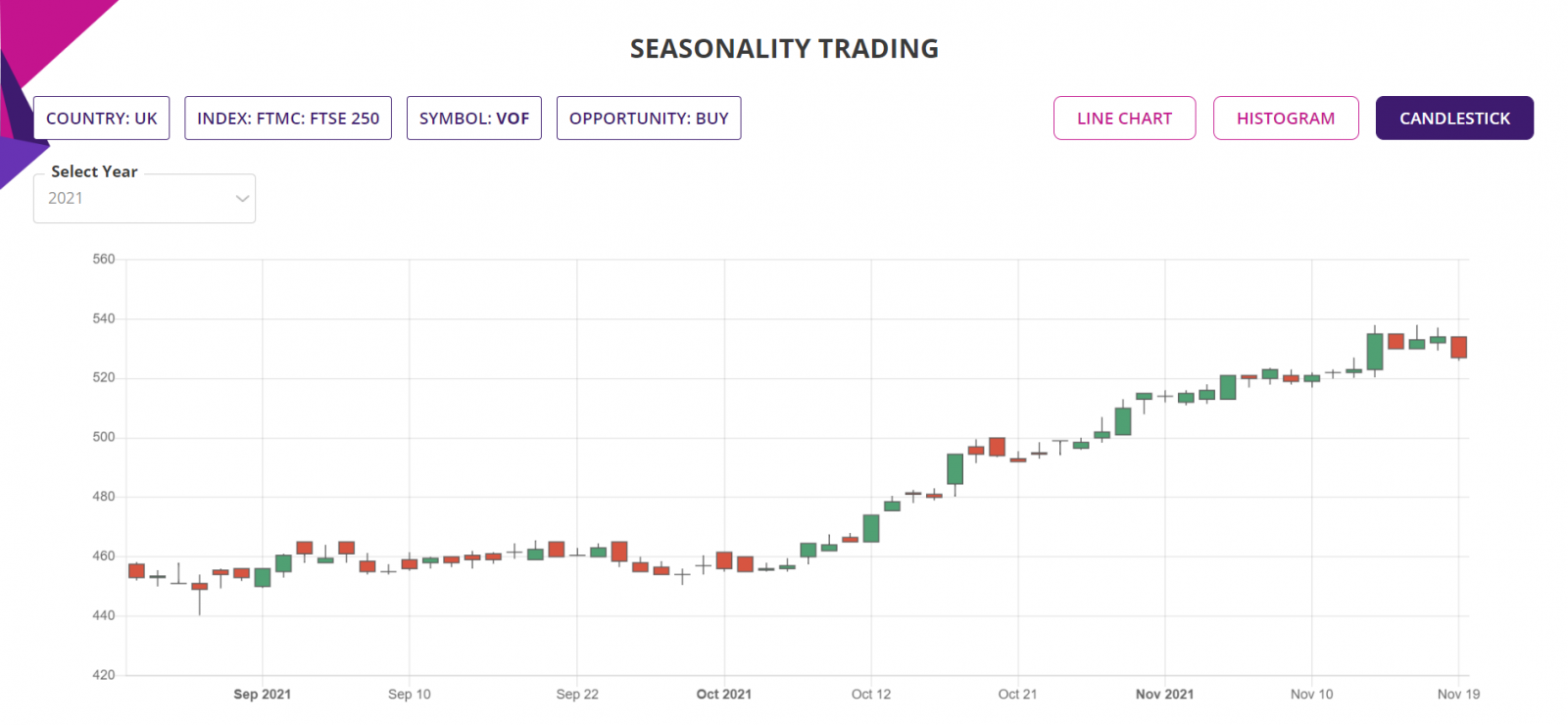

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.