-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-08-14

Date :

2022-08-14

Stock In Focus - Week 33 (2022) – INDIA – VOLUME SPIKE (Database Server Update)

The week beginning Monday, the 15th August is Week 33 as per ISO numbering convention of the weeks of a year. 15th August is Indian Independence day, so the market will open on 16th August.

Country in focus:

This week we look at the Stocks from INDIA in NIFTY 500 index.

Stock/ETF in focus:

Specific Stock in focus is JSW Energy Limited (Ticker: JSWENERGY).

Quick note on the Stock: Energy prices, including electricity retail prices, around the world have been soaring over last few months because of a range of geopolitical factors, contributing to rise of inflation to some extent. We consider this Stock as one to keep in focus because it had very consistent bullish volume spikes over last few years and those spikes were followed by significant surge in price. Please read more details below.

Trade Direction:

BULLISH, Volume Spike study since beginning of 2019 reveal 80% probability of success in a BUY (LONG) trade.

Overview:

JSW Energy Limited generates and sells power in India. The company has a power generation capacity of 4,559 MW, which includes 3,158 MW of thermal, 1,391 MW of hydro, and 10 MW of solar. It has operations in the States of Karnataka, Maharashtra, Rajasthan, Himachal Pradesh, Andhra Pradesh, and West Bengal. The company also engages in power transmission and trading activities; and coal mining in South Africa. JSW Energy Limited was incorporated in 1994 and is based in Mumbai, India.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Utilities

Industry: Utilities—Independent Power Producers

Full-time employees: 1,603

Fundamentals:

52-week range 182.05 - 408.00

Avg. volume 1,495,088

Market cap 526.172B

PE ratio (TTM) 25.24

EPS (TTM) 12.68

Ex-dividend date 30 May 2022

(All prices are in INR, Indian Rupees)

Current trading price:

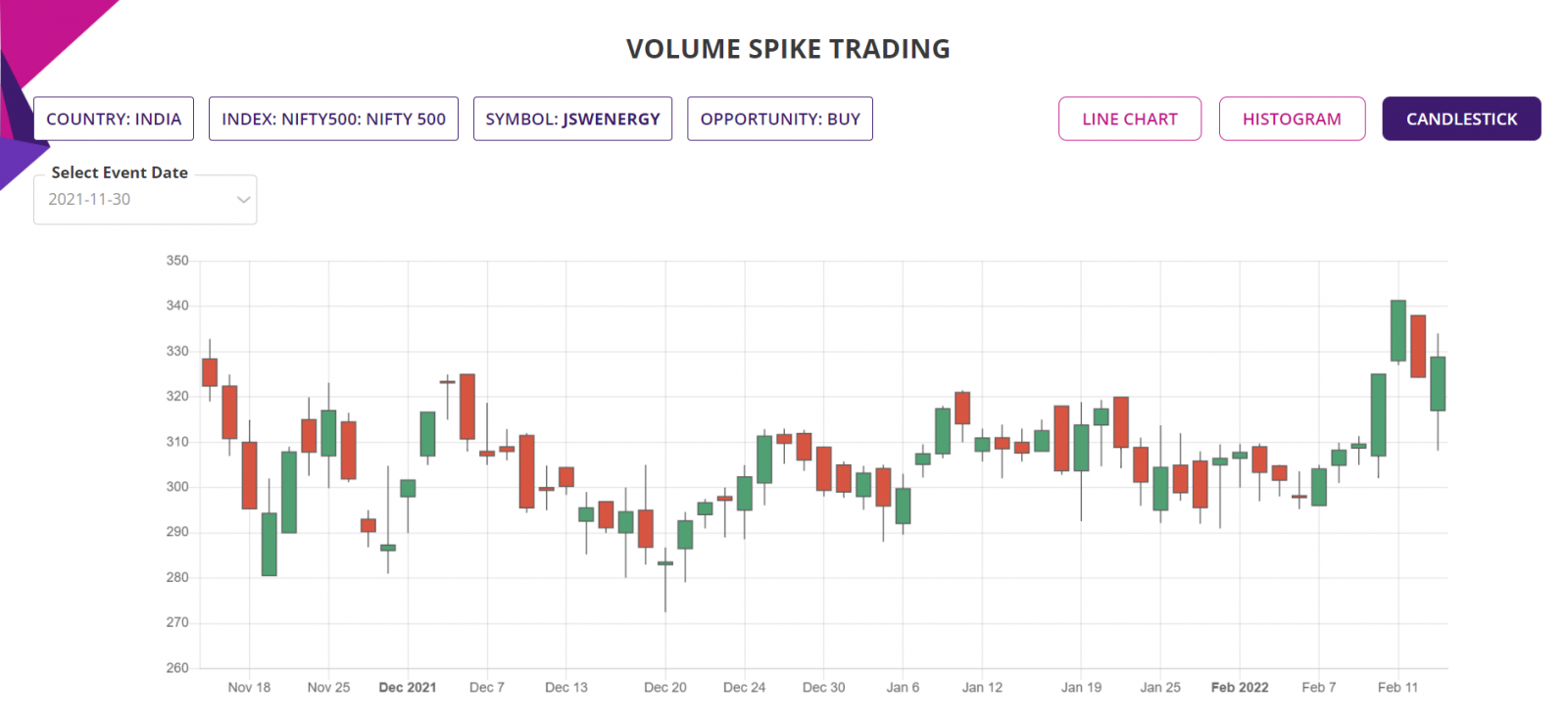

As of Friday, close of 12th August 2022, the stock was trading at 320.05 (Currency: INR).

VOLUME SPIKE:

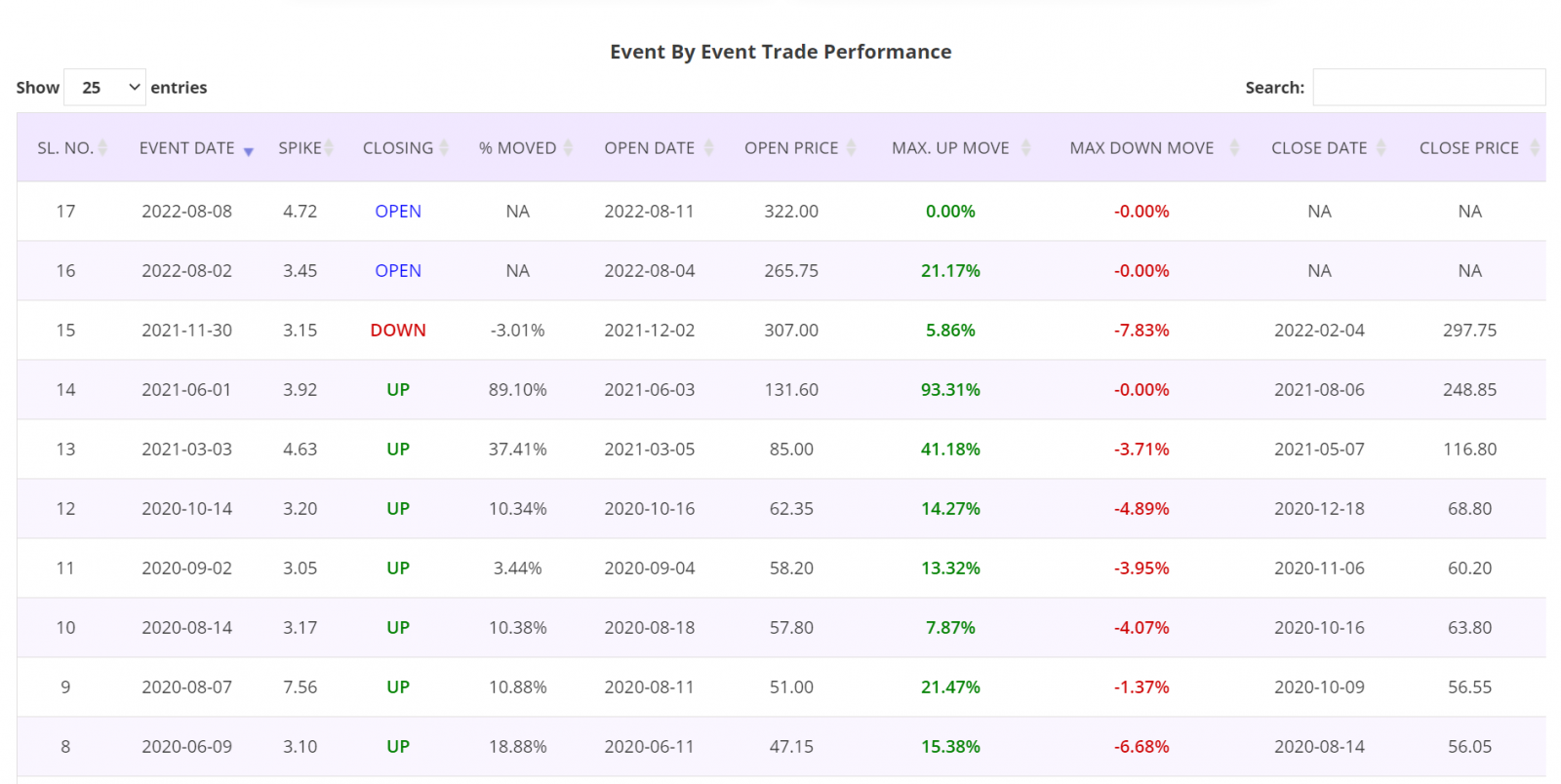

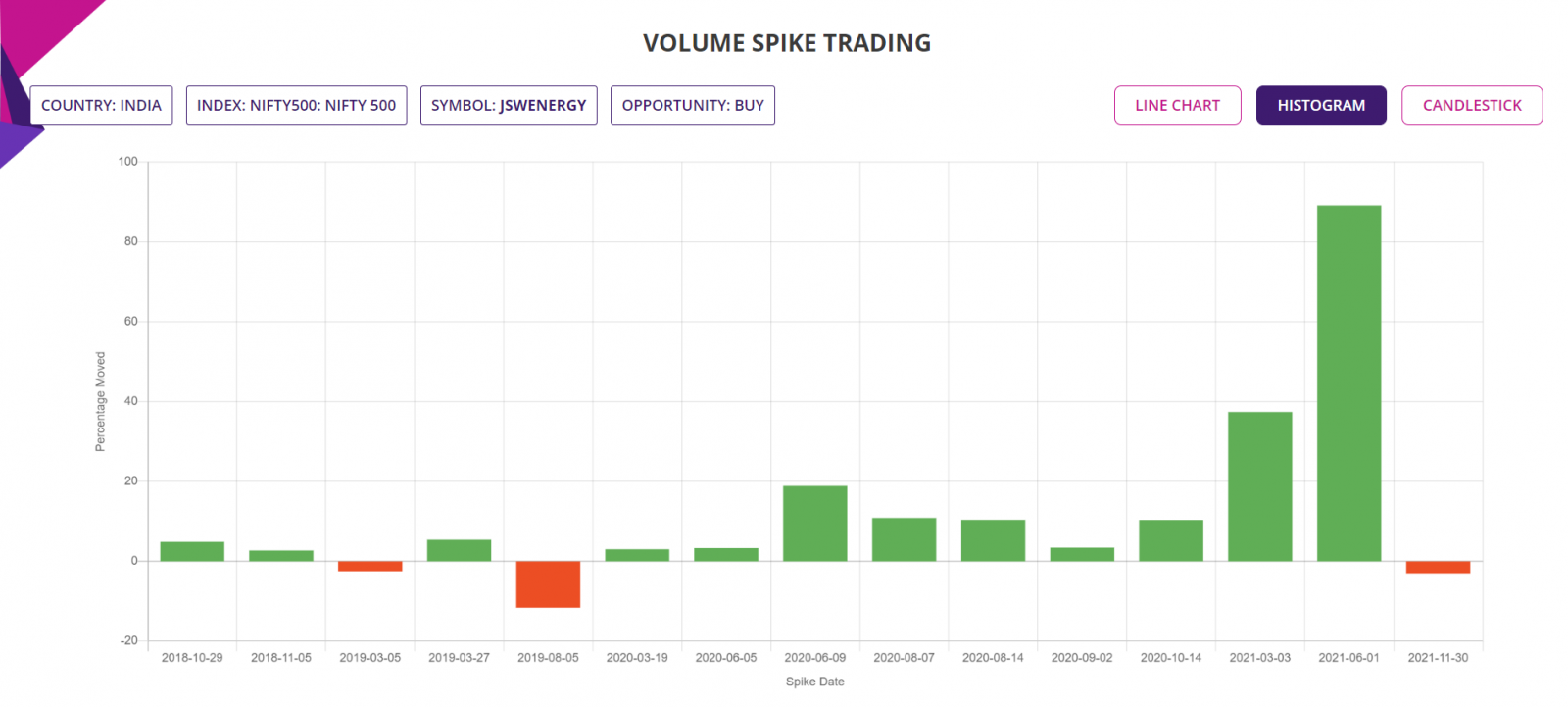

The stock was bullish 80% of the time, following Volume spikes larger than 3X as evident from the details of its behaviour, see below (all prices are in INR):

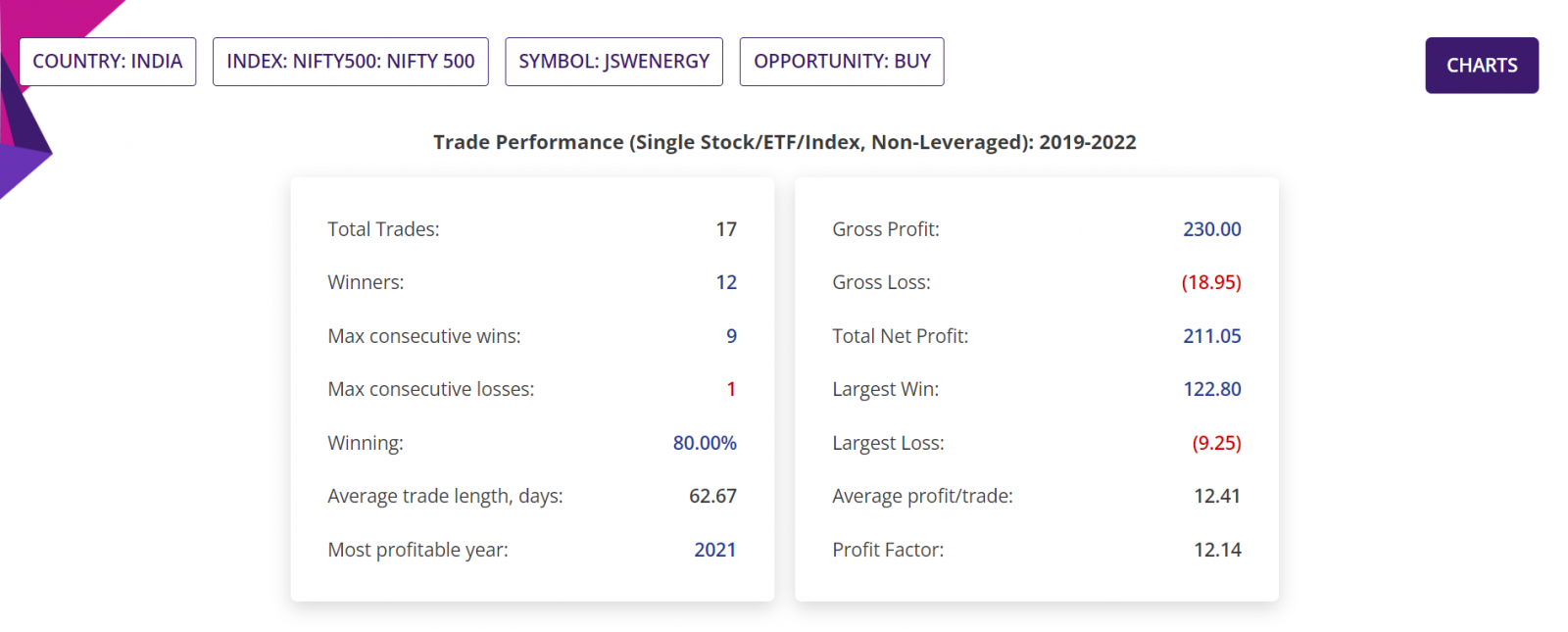

- Since beginning of 2019, there were 17 Volume spikes of size larger than 3X, out of which 12 were followed by large bullish move of the Stock with average move up (AMU) of 19.19% and average move down (AMD) of 4.69% for an average holding time (ADH) of 33 days;

- If 1,000 stocks were bought following those Volume spikes, then a trader would have had a Gross Profit of INR230,000, Gross Loss of INR18,950, making a Total Net Profit of INR211,050;

- In those trades, the Largest Win was INR122,800, Largest Loss is INR9,250, the Average profit/trade being INR12,400.

- The average Reward-Risk Ratio (RRR) in those trades were about 4:1

Trade Structure:

We would trade the Stock as CFD trade, structured as follows with RRR of 4:1:

|

TRADE STRUCTURE (All prices in INR, Indian Rupees) |

||

|

Stock price |

320.05 |

This may vary at market open |

|

Stock quantity |

1,000 |

Number of Stocks used for this trade |

|

Investment required |

320,050.00 |

Amount of fund required for the trade |

|

Target Stock price (TP) |

384.06 |

20% above the current price |

|

Stop Stock price (SL) |

304.05 |

5% below the current price |

|

Profit Target |

64,010.00 |

Limit order placed at underlying TP price |

|

Stop Loss |

16,000.00 |

Guaranteed stop at SL price |

The choice of RRR of 4:1 is historically consistent with the averages following the 15 of the 17 volume spikes since 2019.

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged):

Event by event trade performance (sample):

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.