-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-06-26

Date :

2022-06-26

Stock In Focus - Week 26 (2022) – AUSTRALIA – SEASONALITY

The week beginning Monday, the 27th June is Week 26 as per ISO numbering convention of the weeks of a year.

Country in focus:

This week we look at the Stocks from AUSTRALIA in ALL ORDINARIES index.

Stock/ETF in focus:

Specific Stock in focus Infomedia Ltd (Ticker: IFM.AX), in the Technology Sector and Software Applications industry, trade currency being in AUD.

Trade Direction:

BULLISH, Seasonality study for last 10 years reveal 90.0% probability of success in a BUY (LONG) trade.

Overview:

Infomedia Ltd, a technology company, develops and supplies electronic parts catalogues, service software, data analytics, and business insights for the automotive industry worldwide. The company offers parts solutions, including Microcat EPC, an electronic parts catalogue; Microcat PartsBridge for collision parts ordering; Microcat Market for mechanical parts ordering; Microcat CRM, an online CRM for wholesale parts; Microcat Messenger, an instant messaging tool; and Microcat EPC Origins. It also provides service solutions, such as Superservice Platform; Superservice Menus, a service quoting software; Superservice Triage, an electronic vehicle health check software; Superservice Connect, an online self-serve booking and quoting system; and Superservice Register, an online VIN-specific central database. In addition, the company offers oil industry solutions comprising Netlube Data, a lubricant recommendation database; and Netlube CRM, a frontline sales transformation solution, as well as data management, performance insights, forecasting, customer experience, and dealer optimization services. Infomedia Ltd was incorporated in 1987 and is headquartered in Sydney, Australia.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Technology

Industry: Software—Application

Full Time Employees: 250 (estimated, in 2021)

Fundamentals:

52 Week Range 1.1550 - 1.8050

Avg. Volume 1,288,389

Market Cap 620.007M

PE Ratio (TTM) 61.11

EPS (TTM) 0.0270

Ex-Dividend Date Mar 03, 2022

1y Target Est 1.93

Current trading price:

As of Friday, close of 24th June 2022, the stock was trading at 1.65.

SEASONALITY:

The stock demonstrated strong SEASONAL move in week 26 of the year, here are some of the details of its SEASONAL behaviour:

- In 9 out of last 10 years in week 26, the stock was bullish with average move up (AMU) of 18.78% and average move down (AMD) of 5.33% for an average holding time (ADH) of 48 days.

- If 10,000 stocks were bought in the beginning of week 26 every year for last 10 years, then a trader would have had a Gross Profit of $18,500, Gross Loss of $3,000, making a Total Net Profit of $15,600. All figures excluding commissions.

- In those 10 years, the Largest Win was $5,800, Largest Loss is $3,000, the Average profit/trade being $1,600. All figures excluding commissions.

- The average Reward-Risk Ratio (RRR) in those trades were 3.5: 1 and Profit factor being 6.29.

Trade Structure:

We would trade the Stock as CFD trade, structured as follows with RRR of 3.3:1:

|

TRADE STRUCTURE |

||

|

Stock price |

$1.65 |

AU$ |

|

CFDs |

5,000 |

Number of Stocks used for this CFD trade |

|

Leverage |

10 |

CFD leverage |

|

Margin required |

$825.00 |

Amount of fund required for the trade |

|

Target Stock price (TP) |

$1.85 |

12% above the current price |

|

Stop Stock price (SL) |

$1.59 |

3.6% below the current price |

|

Profit Target |

$1,000.00 |

Limit order placed at underlying price of TP |

|

Stop Loss |

$300.00 |

Guaranteed stop at SL price |

The choice of RRR of 3.3:1 is historically consistent with the averages of the 10 trades in each of the last 10 years in Week 26, since 2012 till 2021.

Charts:

Summary report extract:

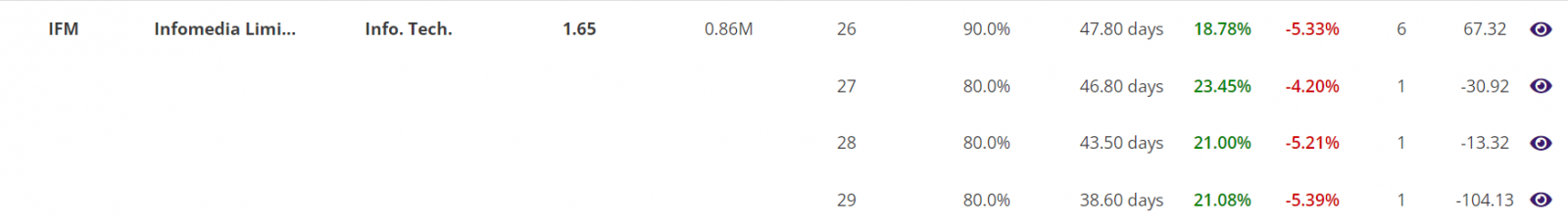

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2012-2021:

Year by year Trade Performance:

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.