-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-06-19

Date :

2022-06-19

Stock of interest - Week 25 (2022) – JAPAN – PRICE ACTION

The week beginning Monday, the 20th June is Week 25 as per ISO numbering convention of the weeks of a year.

Country in focus:

This week we look at the Stocks from JAPAN in NIKKEI 225 index.

Stock/ETF in focus:

Specific Stock in focus is Tokyu Fudosan Holdings Corporation (Ticker: 3289) in the Real Estate Sector and Real Estate—Diversified Industry.

Trade Direction:

BULLISH, Price Action study since 2019 reveal 85.7% probability of success in a BUY (LONG) trade.

Most Recent Event: Price Action event on 16th June 2022, which was Thursday. Preferred trade opening is the next market open day of 20th June 2022.

Overview:

Tokyu Fudosan Holdings Corporation, together with its subsidiaries, engages in the real estate business in Japan and internationally. The company operates through four segments: Urban Development, Strategic Investment, Property Management & Operation, and Real Estate Agents. The Urban Development segment develops and operates office buildings, commercial facilities, condominiums, leased housing, and other facilities. The Strategic Investment segment develops and improves infrastructures, such as renewable energy power generation and logistics facilities. The Property Management & Operation segment manages condominiums, buildings and facilities, and other properties; and constructs rental conference rooms and hotels, as well as leisure, healthcare, and environmental and greening management facilities. The Real-Estate Agents segment provides real-estate sales agent service and consignment sales; and engages in operations related to rental housing management. It also owns and manages resort facilities, urban style hotels, senior housings, and membership sports clubs. The company was founded in 1918 and is headquartered in Tokyo, Japan.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Real Estate

Industry: Real Estate—Diversified

Full Time Employees:

Fundamentals:

52 Week Range 576.00 - 723.00

Avg. Volume 2,846,120

Market Cap 493.453B

PE Ratio (TTM) 14.05

EPS (TTM) 48.84

Ex-Dividend Date Sep 29, 2022

1y Target Estimate 824.20

Current trading price:

As of Friday, close of 17th June 2022, the stock was trading at 686.00 (currency is Japanese Yen or JPY).

PRICE ACTION:

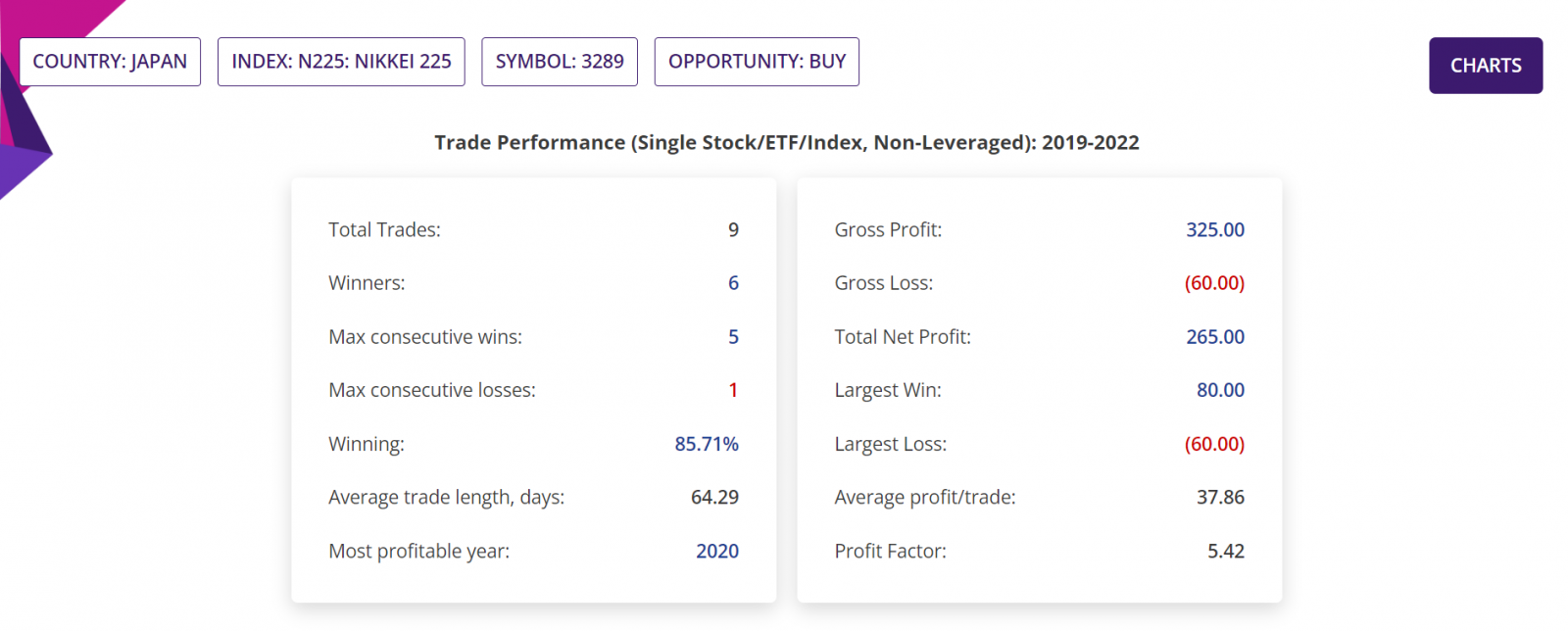

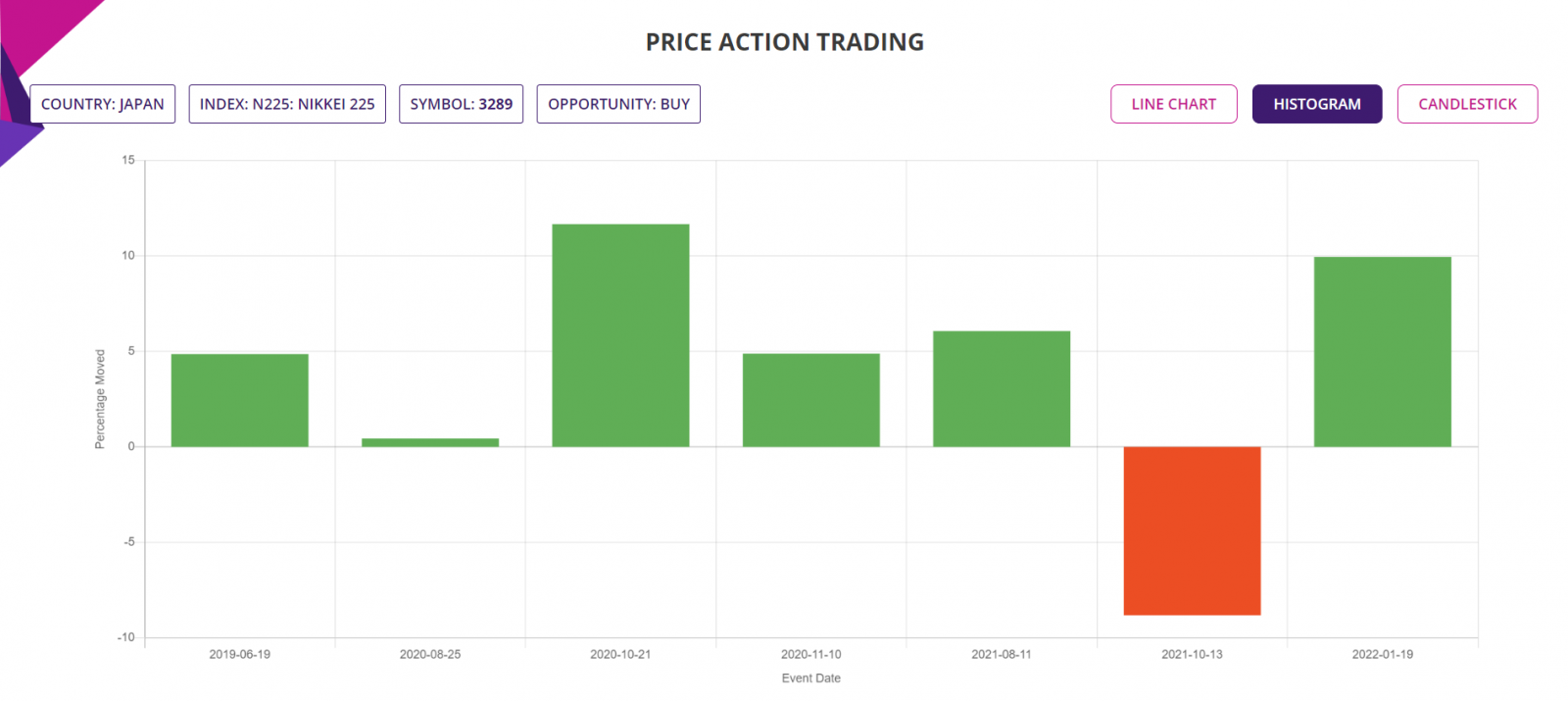

The Stock was bullish almost 86% of the time following Price action events since beginning of 2020. Here is the key Price Action event performance of the Stock:

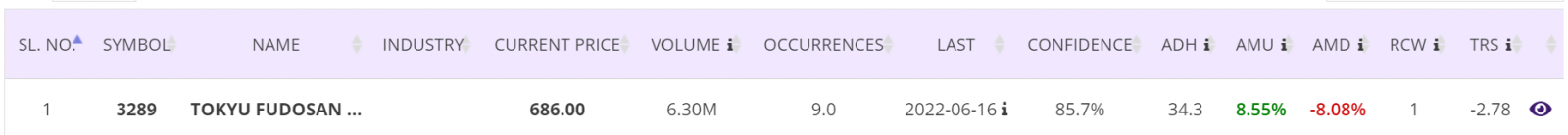

- Since beginning of 2019, there were 9 BULLISH Price action events, out of which 6 were winners with average move up (AMU) of 8.55% and average move down (AMD) of 8.08% for an average holding time (ADH) of 34 days; there are two trade still open as it is within the 9 weeks observation period;

- If 1,000 stocks were bought following those BULLISH Price action events, then a trader would have had a Gross Profit of JPY325,000, Gross Loss of JPY60,000, making a Total Net Profit of JPY265,000;

- In those trades, the Largest Win was JPY80,000, Largest Loss is JPY60,000, the Average profit/trade being JPY37,860.

- The Profit Factor in those trades was 5.42 and historical RRR was about 1.1:1.

Trade Structure:

We would trade the Stock as it is allocating a fund no more than 2% of the trading capital.

Our Profit Target Stock price: 760

Our Loss Limit Stock price: 650

This gives us a RRR of 2:1, which is higher than the averages following the Price Action events since beginning of 2019. As such, this trade an optimistic opportunity with the hope that recent beat-up of global stocks might follow a bullish move and we will achieve the outcome we are aiming for.

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged)

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.