-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-05-28

Date :

2022-05-28

Stock Of Interest - Week 22 (2022) – FRANCE – PRICE ACTION

The week beginning Monday, the 30th May is Week 22 as per ISO numbering convention of the weeks of a year.

Country in focus:

This week we look at the Stocks from FRANCE in CAC 40 index.

Stock/ETF in focus:

Specific Stock in focus is Compagnie de Saint-Gobain S.A. (Ticker: SGO), in the Industrials Sector and Building Products & Equipment industry.

Trade Direction:

BULLISH, Price Action study since 2020 reveal 92.9% probability of success in a BUY (LONG) trade.

Most Recent Event: Price Action event on 26th May 2022. Preferred trade opening is the next market open day of 30th May 2022.

Overview:

Compagnie de Saint-Gobain S.A. designs, manufactures, and distributes materials and solutions for wellbeing worldwide. It operates through five segments: High Performance Solutions; Northern Europe; Southern Europe, Middle East (ME) & Africa; Americas; and Asia-Pacific. The company offers glazing solutions for buildings and cars under the Saint-Gobain, GlassSolutions, Vetrotech, and SageGlass brands; plaster-based products for construction and renovation markets under the Placo, Rigips, and Gyproc brands; ceilings under the Ecophon, CertainTeed, Eurocoustic, Sonex, or Vinh Tuong brands; and insulation solutions for a range of applications, such as construction, engine compartments, vehicle interiors, household appliances, and photovoltaic panels under the Isover, CertainTeed, and Izocam brands. It also offers mortars and building chemicals under the Weber brand; exterior products comprising asphalt and composite shingles, roll roofing systems, and accessories; and pipes under the PAM brand, as well as designs, imports, and distributes instant adhesives, sealants, and silicones. In addition, the company provides interior systems, interior and exterior insulation, cladding, floor coverings, façades and lightweight structures, waterproofing, roofing solutions, pre-assembly, and prefabrication solutions; high performance materials; glass for buildings; plasterboard; and interior glass products. Further, it distributes heavy building materials; plumbing, heating, and sanitary products; timbers and panels; civil engineering products; ceramic tiles; and site equipment and tools. The company was founded in 1665 and is headquartered in Courbevoie, France.

(Courtesy: Yahoo Finance)

Sector and Industry Details:

Sector(s): Industrials

Industry: Building Products & Equipment

Full-time employees: 167,816

Fundamentals:

52-week range 45.76 - 67.12

Avg. volume 1,475,680

Market cap 28.753B

PE ratio (TTM) 11.59

EPS (TTM) 4.76

Earnings date 27 July 2022

1y target estimate 73.92

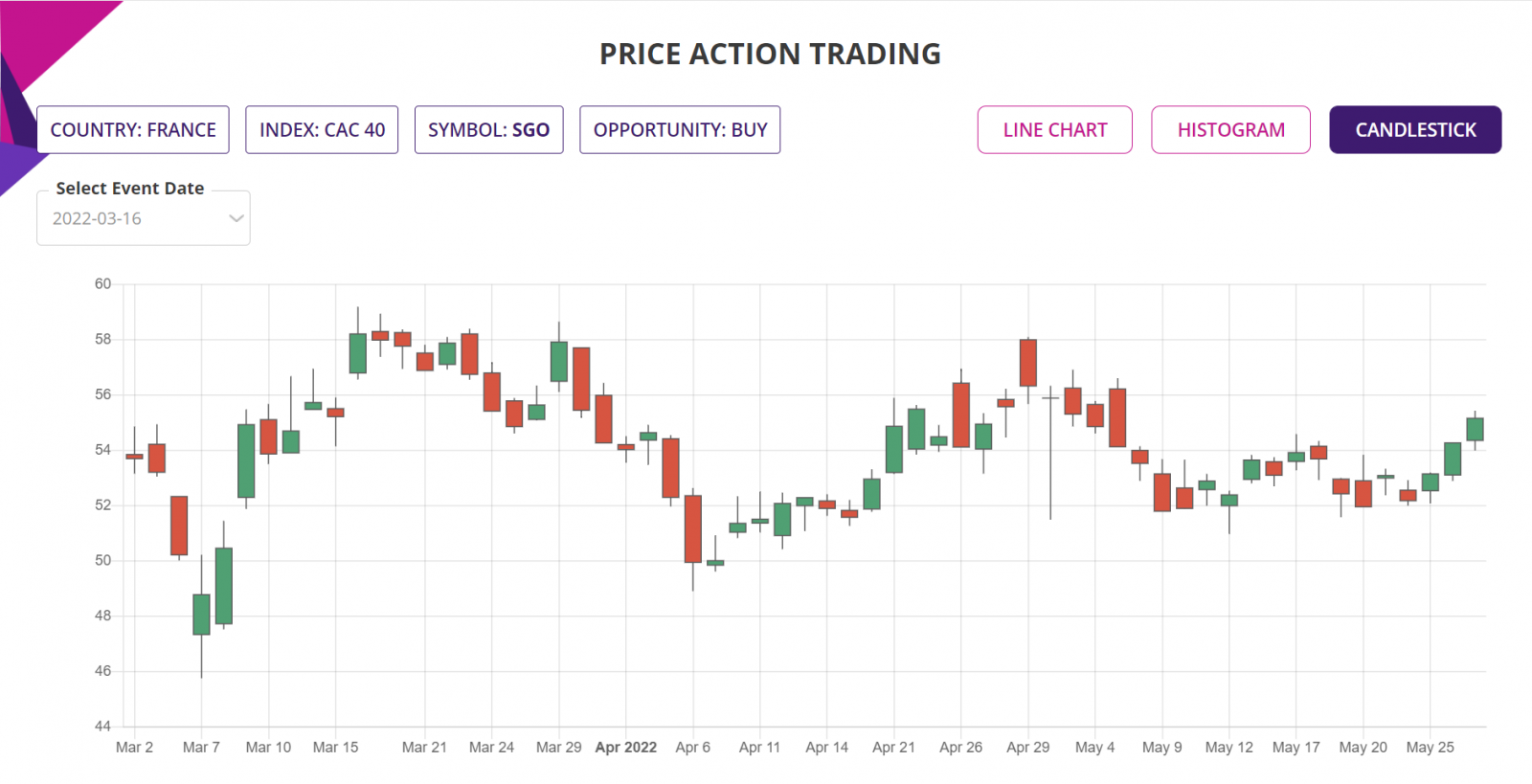

Current trading price:

As of Friday, close of 27th May 2022, the stock was trading at 55.16.

PRICE ACTION:

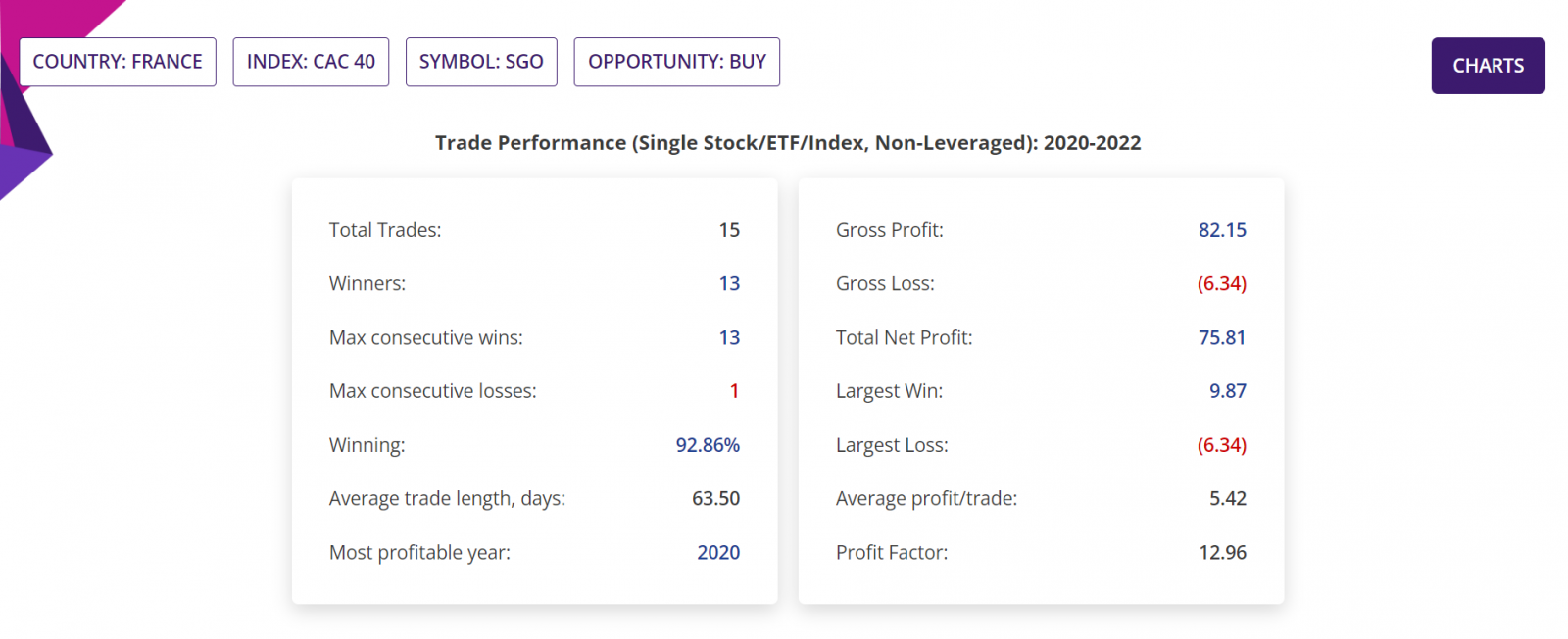

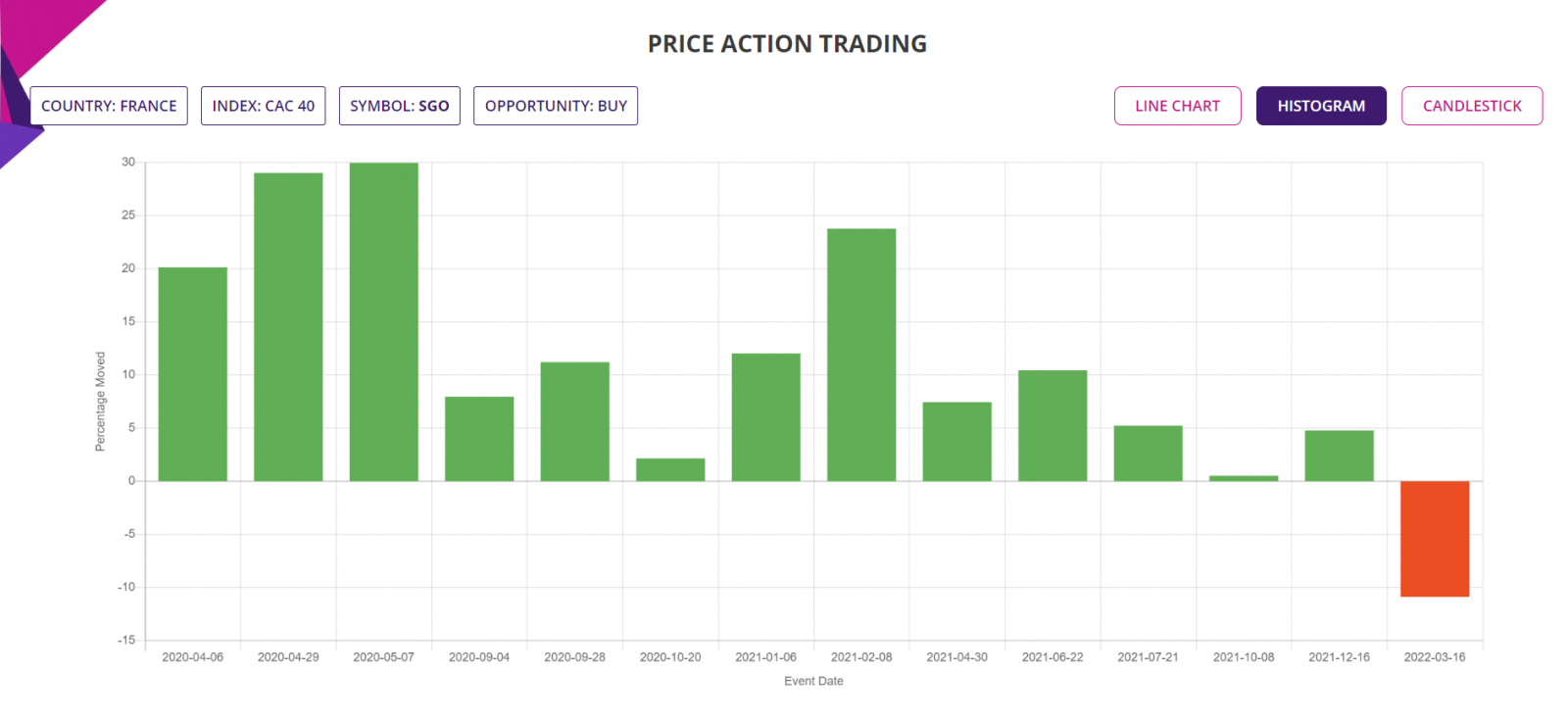

The Stock was bullish almost 93% of the time following Price action events since beginning of 2020. Here is the key Price Action event performance of the Stock:

- Since beginning of 20202, there were 15 BULLISH Price action events, out of which 13 were winners with average move up (AMU) of 15.81% and average move down (AMD) of 6.33% for an average holding time (ADH) of 41.4 days, one trade still open as it is within the 9 weeks observation period;

- If 100 stocks were bought following those BULLISH Price action events, then a trader would have had a Gross Profit of EUR8,215, Gross Loss of EUR634, making a Total Net Profit of EUR7,581;

- In those trades, the Largest Win was EUR987, Largest Loss is EUR634, the Average profit/trade being EUR542.

- The Profit Factor in those trades were about 13 and RRR was about 2.5:1

Trade Structure:

We would trade the Stock as it is allocating a fund no more than 2% of the trading capital.

Our Profit Target Stock price: 60.70

Our Loss Limit Stock price: 52.95

This gives us a RRR of 2.5:1, which is historically consistent with the averages following the Price Action events since beginning of 2020.

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2020-YTD2022:

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

https://www.sapphirecapitals.com/pages/swing-trading-stock-seasonality-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-stock-price-action-strategy/

https://www.sapphirecapitals.com/pages/swing-trading-volume-spike-stock-trading-strategy/

https://www.sapphirecapitals.com/pages/day-trading-intraday-seasonality-trading/

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.