-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-04-10

Date :

2022-04-10

Stock of interest - Week 15 - CANADA - SEASONALITY

Stock of interest - Week 15 - 2022

The week beginning Monday, the 11th April is Week 15 as per ISO numbering convention of the weeks of a year. This is also a short week as Easter Friday is a holiday in many parts of the western world.

Country in focus:

This week we look at the Stocks from Canada in S&P TSX COMPOSITE index.

Stock/ETF in focus:

Specific Stock in focus is Premium Brands Holdings Corporation (Ticker: PBH).

Trade Direction:

BULLISH, 10 years Seasonality with 80% probability of success in a BUY (LONG) trade.

Overview:

Premium Brands Holdings Corporation, through its subsidiaries, manufactures and distributes food products primarily in Canada and the United States. It operates in two segments, Specialty Foods and Premium Food Distribution. The company provides meat products and snacks, deli products, beef jerky and halal, sandwiches, pastries, specialty and gourmet products, salads and kettle products, entrees, panini, wraps, subs, hamburgers, burgers, muffins, breads, pastas, and baking and sushi products, as well as processed meat products and ready-to-eat meals. It is also involved in the distribution of food products, including meat, seafood, and halal food products; operation of retail/convenience store and concessionary; and provision of food and seafood processing, and cold storage services. The company operates under the brand names of Grimm's, Freybe, Piller's, Black Kassel, MarcAngelo, Oberto, Bavarian Meats, McSweeney's, Cattleman's Cut, Harvest Meats, Hempler's, Pacific Gold Country, Prime Meats, Isernio's, Fletcher's (U.S.), Leadbetters, Mclean Meats, Shahir, Expresco, Fresh Additions, Lou's Kitchen, WestEnd, Cobblestone, Yorkshire Valley Farms, Premier Meats, Black River Angus, La Maison Du Gibier, Belmont Meats, Purely Crafted, Cowboy, Connie's Kitchen, Skoulakis, Premier Healthy Living, Raybern's, Hygaard, Quality Fast Foods, Buddy's, Bread Garden Go, Stovers Kitchen, Deli Chef, Leonetti's, Island City, Stuyver's, La Boulangerie, Vero Vero, Alive & Rise, Partners, Audrey's, Duso's, Gourmet Chef, Smart Soup, Clearwater, Hancock Gourmet, Diana's Seafood, Marco Polo, Seafood Lover, Ready Brothers, Cold Cracked Lobster, Maximum Seafood, Rocky Point. It serves chains and large format retailers, independent and specialty retailers, foodservice operators, foodservice distributors, and other food manufacturers and food brokers. The company was founded in 1917 and is headquartered in Richmond, Canada.

Fundamentals:

52 Week Range 100.41 - 137.75

Volume 61,346

Avg. Volume 104,044

Market Cap 4.732B

PE Ratio (TTM) 34.75

EPS (TTM) 3.04

1y Target Est 145.30

Current trading price:

As of Friday close, the stock was trading at 105.63.

SEASONALITY:

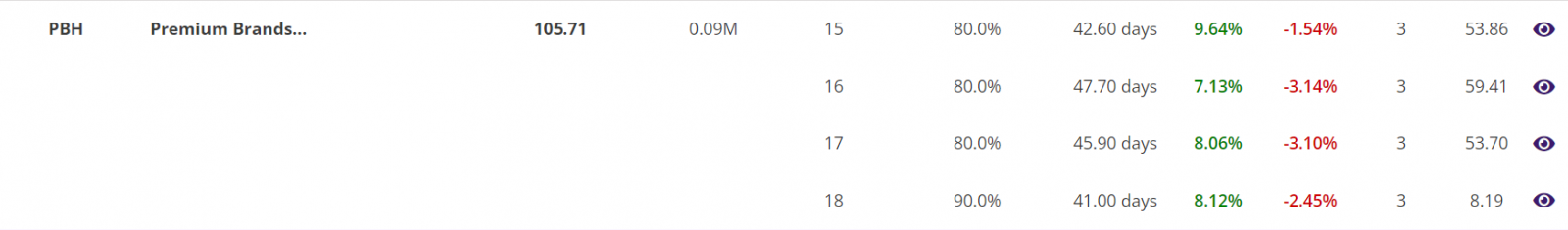

The stock demonstrated strong seasonal move in week 15 of the year, here are some of the details of its seasonal behaviour:

- In 8 out of last 10 years in week 15, the stock was bullish with average move up of 9.64% and average move down of 1.54% for an average holding time of 43 days.

- If 100 stocks were bought in the beginning of week 15 every year for last 10 years, then a trader would have had a Gross Profit of $4,875, Gross Loss of $364, making a Total Net Profit of $4,511.

- In those 10 years, the Largest Win was $1,310, Largest Loss is $305, the Average profit/trade being $451.

- The average Reward-Risk Ratio (RRR) in those trades were about 13:1.

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2012-2021:

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

- www.sapphirecapitals.com/seasonalitytrading

- www.sapphirecapitals.com/volumespiketrading

- www.sapphirecapitals.com/priceactiontrading

- www.sapphirecapitals.com/seasonalitydaytrading

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.