-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-03-19

Date :

2022-03-19

Stock of interest - Week 12 - 2022 - India - Volume Spike

The week beginning Monday, the 21st March is Week 12 as per ISO numbering convention of the weeks of a year.

Stock in focus:

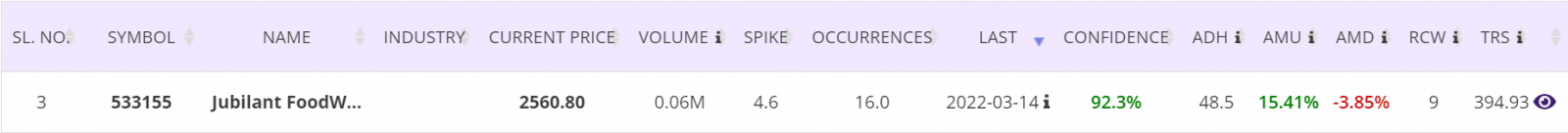

This week starts with several Indian stocks from BSE SENSEX500 index in view such as DAMART, 503310 (Swan Energy), ADANITRANS, 500790 (Nestle) and many more. Specific Stock in focus is Jubilant FoodWorks Ltd (BSE SENSEX Ticker: 533155).

Trade Direction:

BULLISH, recent VOLUME SPIKE with 92.3% probability of success in a BUY (LONG) trade.

Overview:

Jubilant FoodWorks Limited is an Indian food service company based in Noida, Uttar Pradesh which holds the master franchise for Domino's Pizza in India, Nepal, Sri Lanka and Bangladesh, for Popeyes in India, Bangladesh, Nepal and Bhutan, and also for Dunkin' Donuts in India. The company also operates two homegrown restaurant brands called Ekdum! and Hong's Kitchen.

Jubilant FoodWorks was named "Emerging Food Group of the Year" by The Economic Times in 2012.

Fundamentals:

52 Week Range 1,141.80 - 3,127.25

Volume 55,753

Avg. Volume 47,627

Market Cap 337.954B

PE Ratio (TTM) 251.38

Current trading price:

As of Friday close, the stock was trading at 2,560.80.

VOLUME SPIKE:

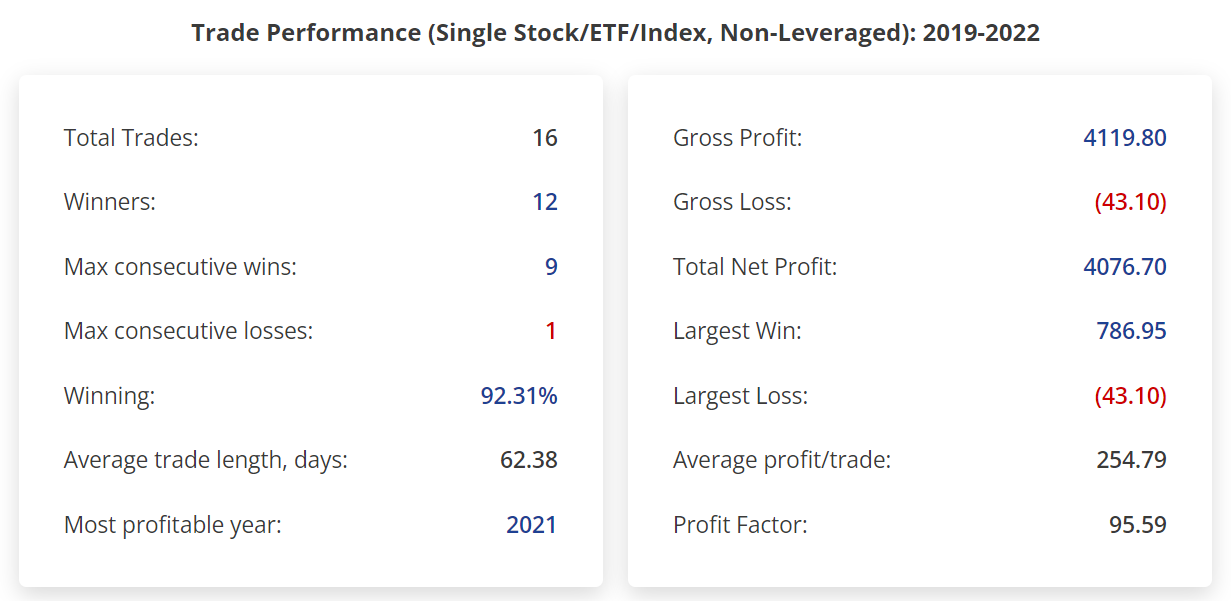

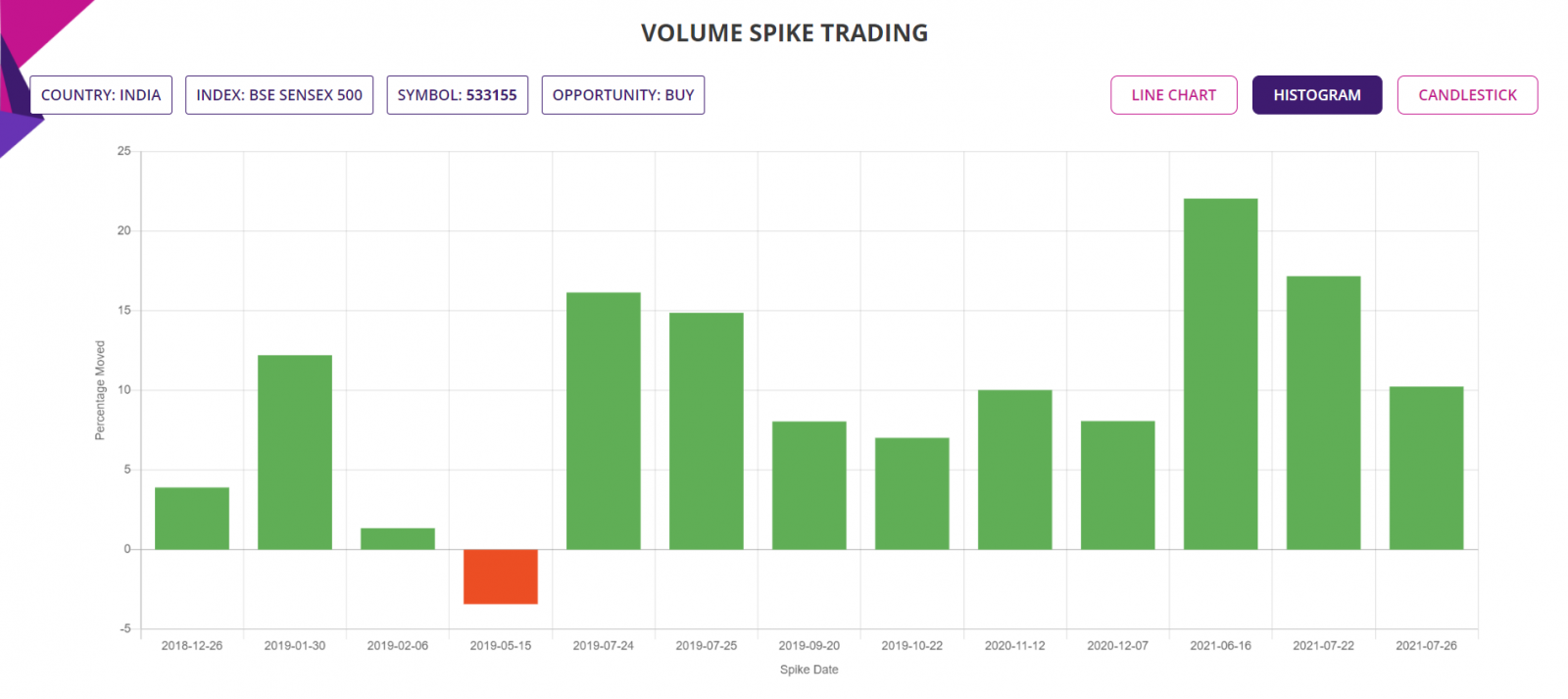

The volume spike event performance of the Stock was as follows, since January 2019 till date:

- In 12 out of last 13 volume spikes with spike size over 3 X, the stock was bullish with average move up of 15.41% and average move down of 3.85% for an average holding time of 48.5 days;

- If 100 stocks were bought following each of those volume spikes since January 2019, then a trader would have had a Gross Profit of INR4,11,980, Gross Loss of INR4,310, making a Total Net Profit of INR4,07,670;

- In those trades following the 13 volume spike events, the Largest Win was INR78,695, Largest Loss is INR4,310, the Average profit/trade being INR25,479.

- The average Reward-Risk Ratio (RRR) in those trades were about 95:1

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2019-2021:

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

- www.sapphirecapitals.com/seasonalitytrading

- www.sapphirecapitals.com/volumespiketrading

- www.sapphirecapitals.com/priceactiontrading

- www.sapphirecapitals.com/seasonalitydaytrading

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.