-

Admin123 :

Admin - Sapphire Capitals

Admin123 :

Admin - Sapphire Capitals -

Date :

2022-03-12

Date :

2022-03-12

[BONUS] Stock of interest - Week 11 of 2022 - UK - CWK & 3IN

Stock of interest - Week 11 - 2022

The week beginning Monday, the 14th March is Week 11 as per ISO numbering convention of the weeks of a year. We will talk about the Stock in focus plus BONUS Stock, please read on.

Stock in focus:

This week starts with several stocks in view ICP, BAB, CLI and many more. Specific Stock in focus is Cranswick Plc (LSE Ticker: CWK). BULLISH

Why: Seasonality with 90% probability of success in a BUY (LONG) trade

Overview:

Cranswick plc produces and supplies food products to grocery retailers, food service sector, and other food producers in the United Kingdom, Continental Europe, and internationally. The company offers fresh pork, gourmet bacon and gammon, fresh and cooked chicken, and prepared chicken and poultry products, as well as gourmet sausages, cooked meats, continental foods, gourmet pastries, and ingredients. It also offers snacking products under Bodega brand, as well as operates export business. The company was incorporated in 1972 and is based in Hessle, the United Kingdom.

Fundamentals:

Market cap 1.851B

PE ratio (TTM) 17.38

EPS (TTM) 189.30

1y target est 4,405.63

52-week range 2,600.00 - 4,200.00

Volume 135,684

Avg. volume 93,694

Current trading price:

As of Friday close, the stock was trading at 3290.

Seasonality:

The stock demonstrated strong seasonal move in week 11 of the year, here are some of the details of its seasonal behaviour:

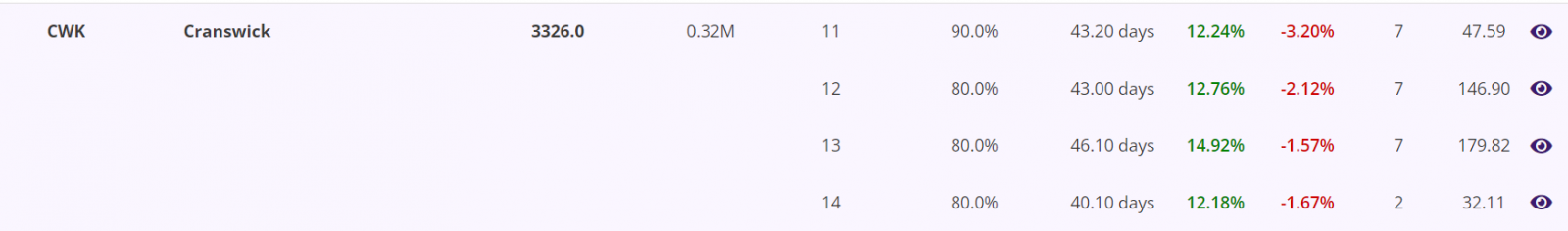

- In 9 out of last 10 years in week 11, the stock was bullish with average move up of 12.24% and average move down of 3.20% for an average holding time of 43 days;

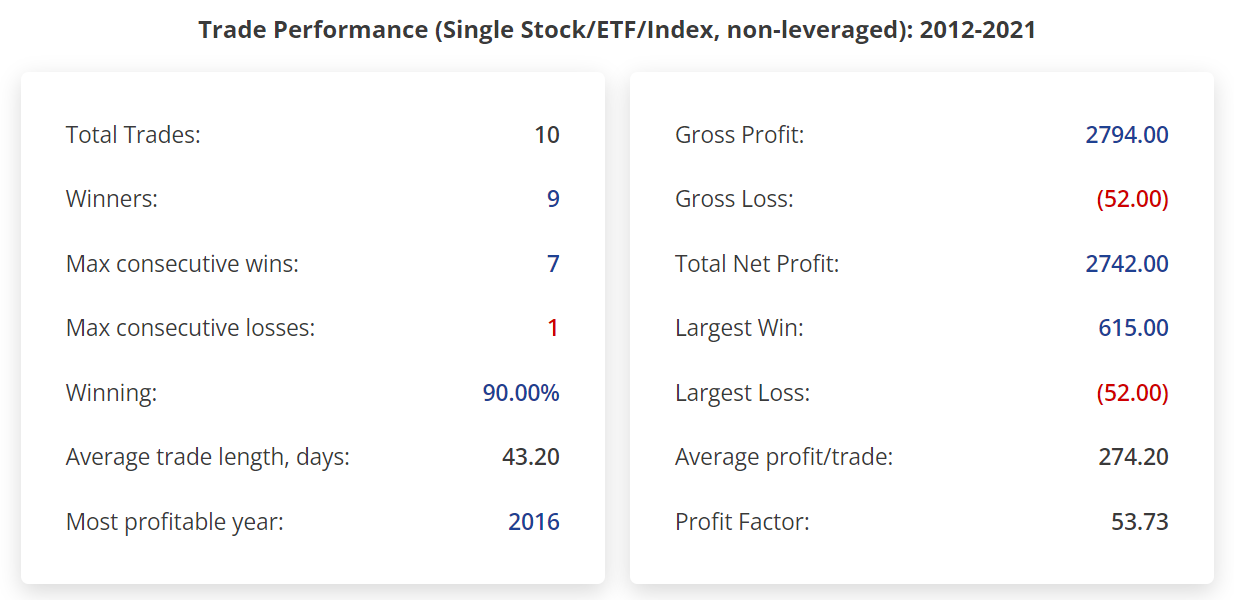

- If 100 stocks were bought in the beginning of week 11 every year for last 10 years, then a trader would have had a Gross Profit of GBP2,794, Gross Loss of GBP52, making a Total Net Profit of GBP2,742;

- In those 10 years, the Largest Win was GBP615, Largest Loss is GBP52, the Average profit/trade being GBP274.20.

- The average Reward-Risk Ratio (RRR) in those trades were about 53:1

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2012-2021:

Seasonality Histogram:

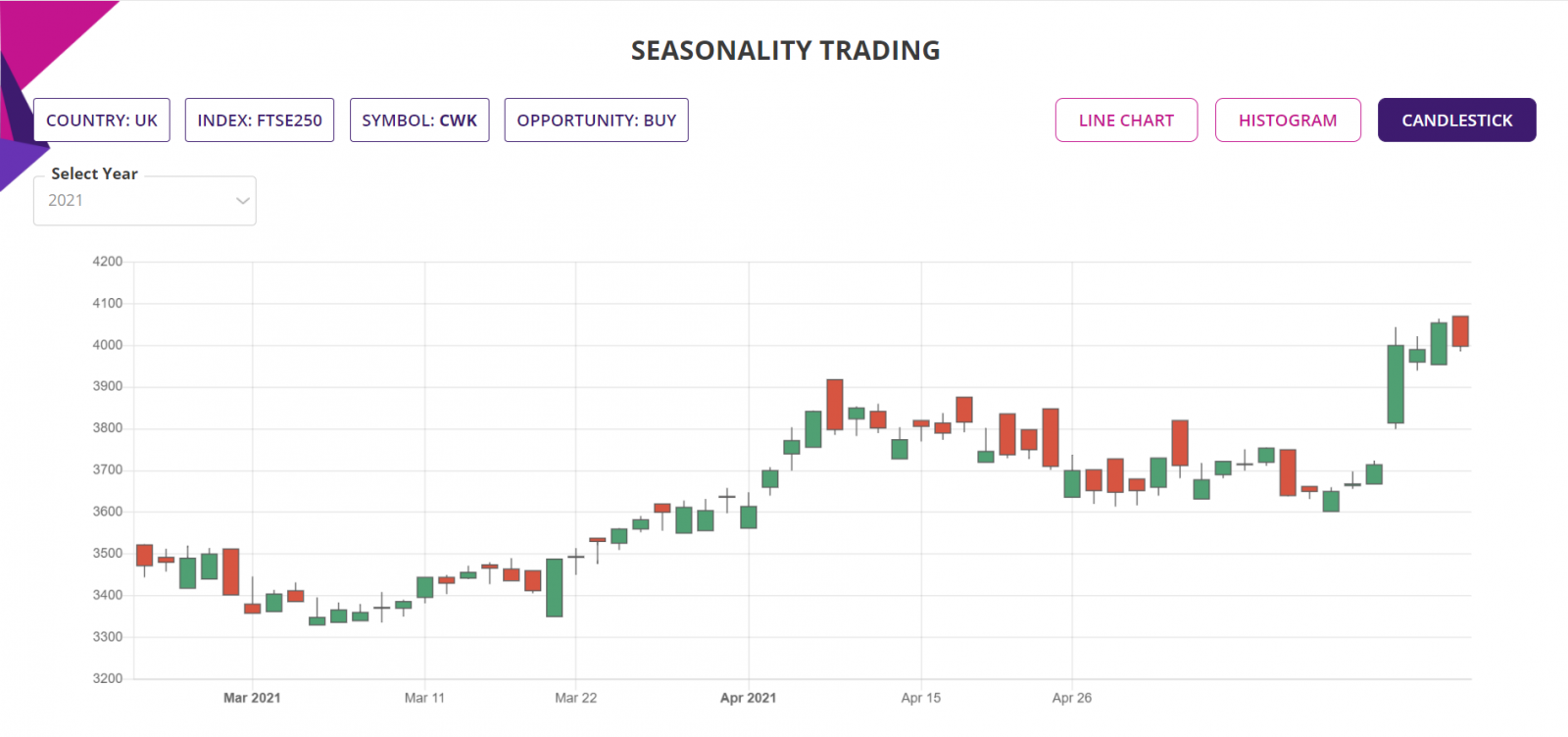

Latest event candlestick chart:

[BONUS]

Stock in focus:

The Specific Stock in focus is 3i Infrastructure Plc (LSE Ticker: 3IN). BULLISH

Why: Price Action with 74% probability of success in a BUY (LONG) trade

Overview:

3i Infrastructure plc is an investment firm specializing in infrastructure investments. The firm invests in early-stage assets, mature assets, middle markets, mid venture, acquisitions, and projects and privatizations undergoing a period of operational ramp-up. It may invest in junior or mezzanine debt in infrastructure businesses or assets. The firm primarily invests in core infrastructure companies and assets with a focus on the utilities, transportation, energies, social infrastructure, and adjacent sectors; primary PPP with a focus on greenfield projects in education, transport, healthcare; public sector accommodation sectors and low-risk energy projects with a focus on wind, solar, offshore transmission in developed markets; and mid-market economic infrastructure with a focus on low-risk energy projects.

Fundamentals:

Market cap 3.333B

PE ratio (TTM) 8.39

EPS (TTM) 41.70

1y target est 380.00

52-week range 287.65 - 366.00

Volume 711,047

Avg. volume 967,350

Current trading price:

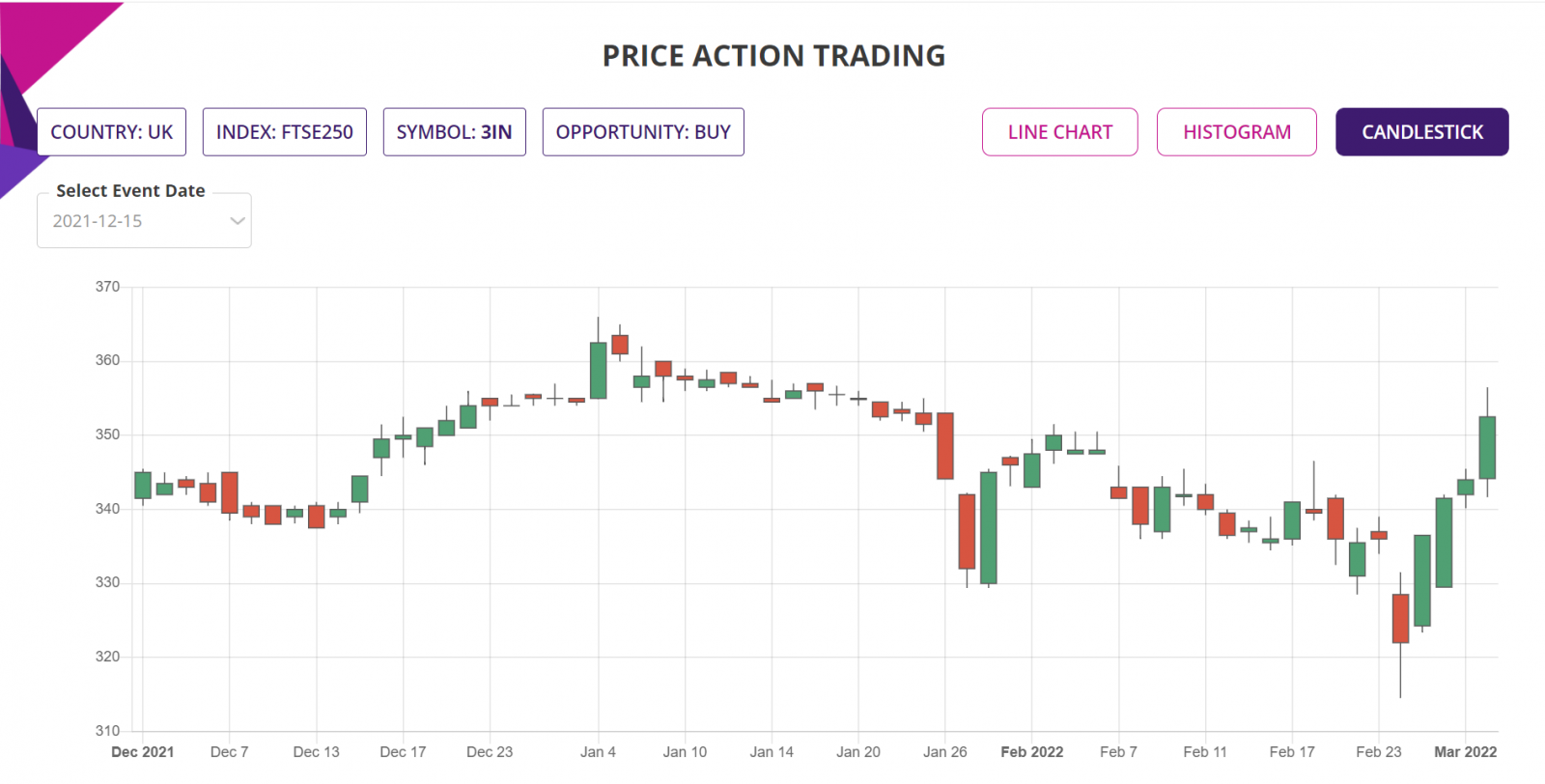

As of Friday close, the stock was trading at 350.

Price Action:

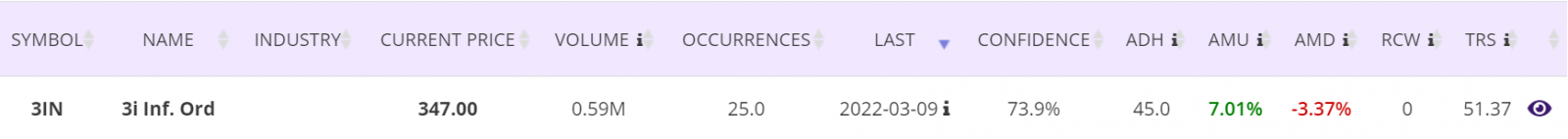

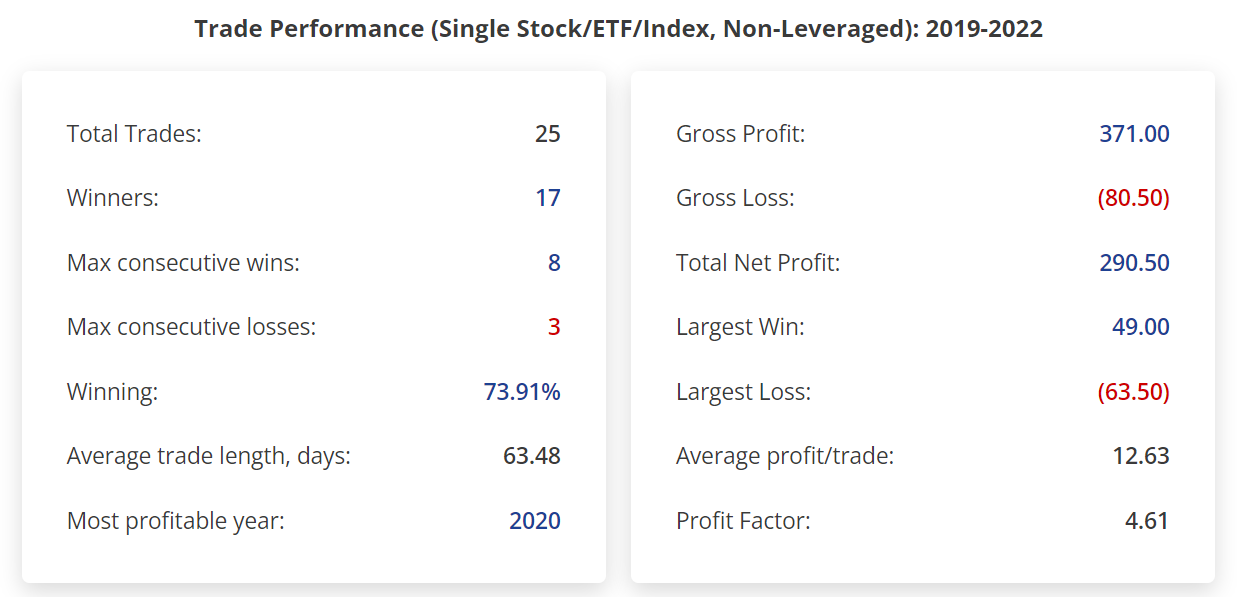

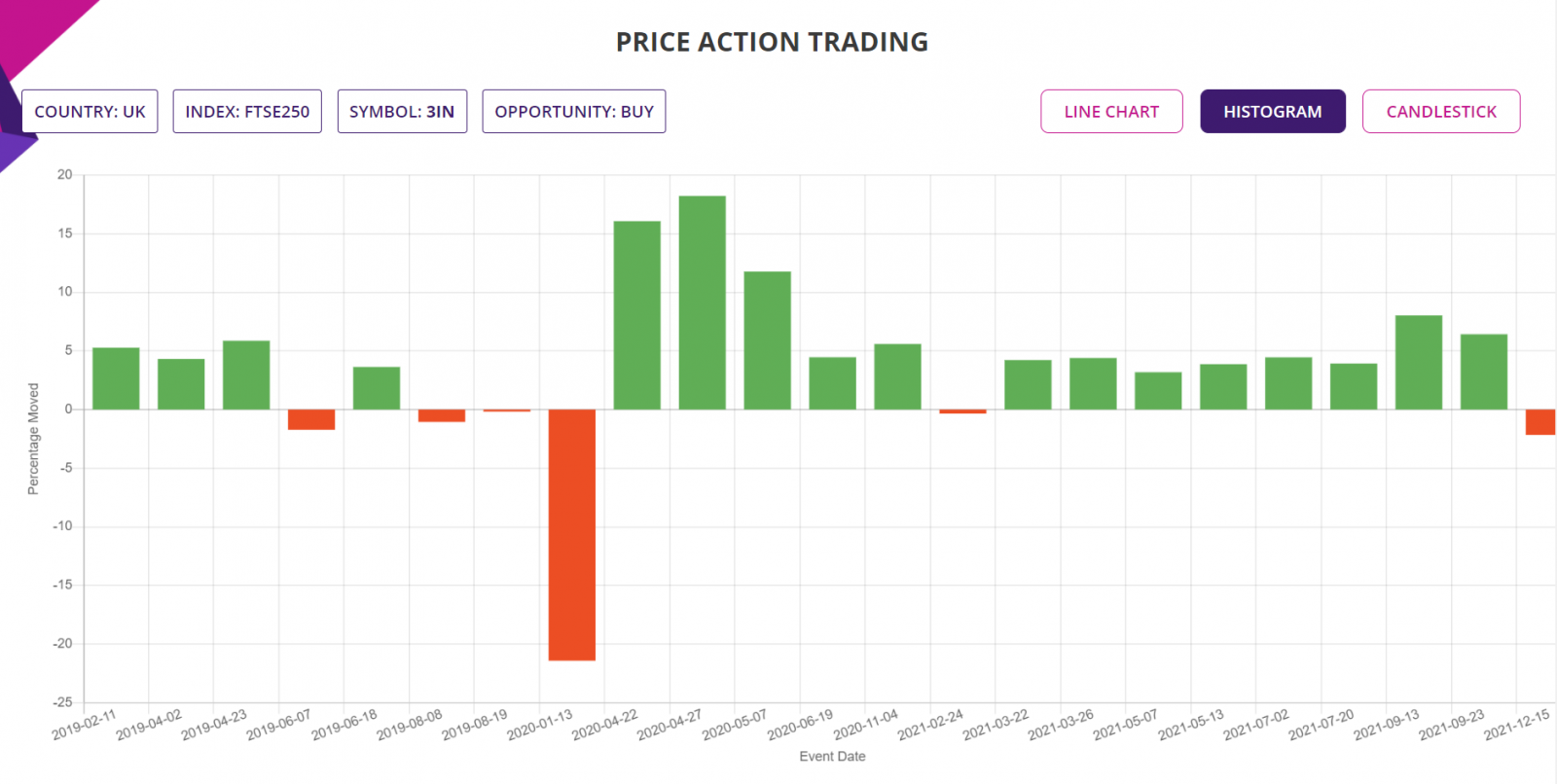

The stock reasonably strongly follows price action events for bullish and bearish moves, here are some of the details of its price action behaviour:

- Since 2019, there were 25 BULLISH price action events for this Stock, out of which 17 were winners with average move up of 7.71% and average move down of 3.37% for an average holding time of 45 days;

- If 1000 stocks were bought the following day after those BULLISH price action events, then a trader would have had a Gross Profit of GBP3,710, Gross Loss of GBP805, making a Total Net Profit of GBP2,905;

- In those trades, the Largest Win was GBP490, Largest Loss is GBP635, the Average profit/trade being GBP126.30.

- The average Reward-Risk Ratio (RRR) in those trades were about 4.61:1

Charts:

Summary report extract:

Trade Performance (Single Stock/ETF/Index, non-leveraged): 2019-2021:

Histogram:

Latest event candlestick chart:

Further Information about trading applications:

Please visit the following URL for more information on various trading applications from Sapphire Capitals which are designed to deliver high probability trading opportunities for swing trading as well as for intraday trading:

- www.sapphirecapitals.com/seasonalitytrading

- www.sapphirecapitals.com/volumespiketrading

- www.sapphirecapitals.com/priceactiontrading

- www.sapphirecapitals.com/seasonalitydaytrading

Disclaimer:

Sapphire Private Assets (ABN: 34 613 892 023, trading as Sapphire Capitals) is not a broker or a financial adviser but an education and research organisation; we provide training and tools for traders and DIY fund managers for trading in global financial markets. The contents of the blog have been produced by using technical analysis and trading applications developed by Sapphire Capitals for the Stock and ETF traded worldwide. The contents of this blog are intended for education and research purposes only and is not a recommendation or solicitation to invest in any Stock or ETF.

For more details, please visit www.sapphirecapitals.com/Disclaimer.